France’s unemployed population fell by 46,600 in September. In this respect, the third quarter was the best since 2007. However, if strikes were to increase in number, they could shorten what remains of positive momentum before the slowdown announced for 2020, ING Economic reported.

The unemployed population figures published for September showed a further significant decline, after the 20,100 fewer unemployed registered in August. At 46,600, the September figure brings the fall in unemployment to 55,900 in the third quarter.

However, this statistic had suffered in recent months from a delayed impact of the "yellow vest" crisis, with a cumulative increase of 20,500 people between May and July.

As a result, the fall in the last two months, the most significant in recent years, is a sign of an improvement.

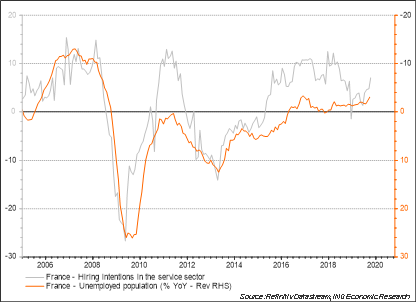

In view of the results of the latest surveys in the service sector, which indicated a strengthening of hiring intentions, the decline in unemployment is expected to accelerate in the second half of the year after the 3.1 percent decline recorded in September.

"This would allow the unemployment rate to continue to fall in the second half of the year: we expect it to drop from 8.2 percent in June to 7.9 percent at the beginning of 2020," ING further commented in the report.

With the French economy more dependent on services than industry, which accounts for around 15 percent of value added (half of German value added), most recent surveys confirm that the French economy should resist the current global slowdown longer than the rest of the euro area.

GDP growth in 3Q19 will be published next week and should show continued strong domestic demand, paving the way for GDP growth of 1.3 percent this year, the report added.

However, the last official projections for 2020, at 1.2 percent, are already looking rosy given the slowdown observed in neighbouring countries.

"As for the fall in the unemployment rate, we expect it to end with the slowdown in GDP growth around mid-2020, but it should accelerate to levels below 8.0 percent by then," further comments noted in the report.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances