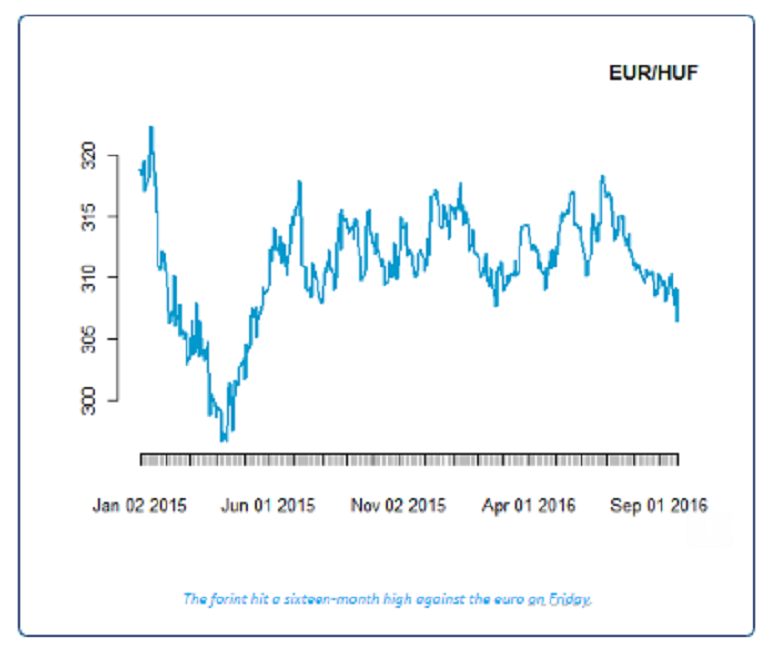

The Hungarian forint hit a fresh 16-month high on Friday, against the euro, following improved economic outlook rating by the Standard & Poor amid further support from the Federal Reserve’s decision to keep the key interest rate unchanged.

Regardless of recent gains, the room for further significant appreciation of the forint and the zloty in the weeks ahead appears limited. Minutes from the last meeting of the National Bank of Poland, released Thursday, mentioned the running debate about a possible rate cut. According to the minutes, certain Council members suggested that the interest rate cut could be justified already in the following few quarters.

However, for the time being, the call for a rate cut has been weak (identical quote could be found in the previous minutes, too) and therefore keep our outlook remains unchanged for stable rates in the near term. On the other hand, comments like this can put a cap on zloty´s exchange rate. Technically, the next support levels have been seen at EUR/PLN 4.26 and 4.23 (2016 high), KBC reported.

A similar scenario holds also for Hungary; further gains of the forint would likely spur central bankers to consider additional rate cuts, which are, in fact, to some extent already anticipated.

Meanwhile, at 17:05GMT, EUR/HUF fell 0.15 percent to 305.62, while it fell 0.23 percent to 272.48 against the greenback.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality