BoE MPC voted unanimously (9-0 vote) to hold rates steady at a record low level of 0.5 per cent at Thursday's meeting, in line with broad market expectation. The meeting echoed Carney's dovish message, Ian McCafferty the lone hawkish member also changed his stance and no longer votes for an immediate rate increase. As expected, the paths for inflation, GDP growth and the unemployment rate were all lowered in the Inflation Report. The central bank revised lower its economic growth forecast to 2.2 percent in 2016 and 2.3 percent in 2017, down from 2.5 percent and 2.6 percent predicted in November.

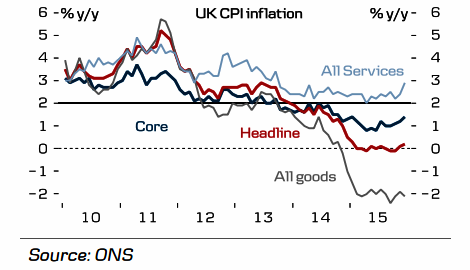

BoE governor Carney flagged weak global growth concerns stressing that impact of EM slowdown on Britain's economic progress. He highlighted the risks arising from turbulent financial markets, capital outflows and rebalancing of the Chinese economy and noted that risks to Britain are rising. Subdued inflation and wage growth in UK, falling inflation expectations and looming Brexit uncertainties likely to keep BoE on hold. Bank of England Deputy Governor Ben Broadbent said on Friday the recent drop in oil prices is likely to keep British inflation below 1 percent throughout this year. Broadbent repeated his view that there is no urgent need to raise interest rates.

With the recent decline in sterling and global interest rates, there is a less potential for higher UK interest rates in the near term. Expectations are rising for the BoE to stay on hold through 2016. However, a lot of pessimism is already priced in on the UK economy, with a nearly one-third probability of a rate cut priced into the UK money market by the end of 2016. Also, more importantly, other central banks have stepped up monetary policy easing recently. The ECB is now expected to ease in March, the Bank of Japan has introduced a negative policy rate in January to the surprise of markets, and market participants no longer expecting that the Fed will hike this year.

"In this respect being on hold is actually quite hawkish in the current environment and consequently there are little prospects of a BoE rate hike this year. We have thus postponed our expectations of the first BoE hike to Q1 17, probably in February (previous Q2 16, probably in May)", says Danske Bank in a research report.

The only really bright spot left in the BoE's chart book is the labour market, which, however, has not normalised completely yet as the BoE still thinks there is some slack left. The BoE argues that long-term unemployment is still elevated and many part-time workers are not able to find full-time work. However, the BoE fears that wage growth will stay subdued due to second-round effects kicking in.

There is little scope for a strong GBP rally in the coming months due to the looming EU referendum. GBP has started the new year on a very weak note and might still suffer due to rising uncertainty as the referendum moves closer. EUR/GBP was trading at 0.7703 and GBP/USD was at 1.4535 at the time of writing as of 1110 GMT.

"We look for EUR/GBP to be fairly trendless and very volatile in the coming months with the risks skewed towards further EUR/GBP upside going into a possible EU referendum in June", adds Danske Bank.

First BoE rate hike expectations pushed to Q1 2017

Friday, February 5, 2016 11:56 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings