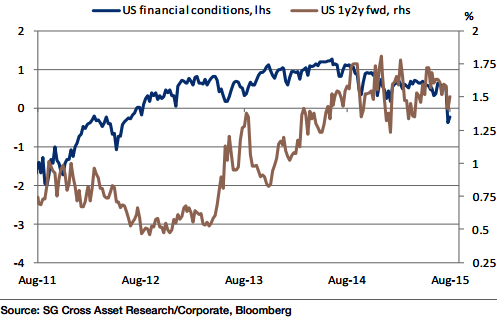

Comments by Fed members suggest the FOMC could still raise interest rates on 17 September. This is the base case scenario due to the optimism for rising US wage growth. It is cognizant of the greater uncertainty due to financial market turmoil and worries of negative spillovers from China/Asia.

Futures markets have cut the probability of a 25bp increase to less than 35%. In other words, a rate increase would come as a surprise, but how will markets respond? Buy USD or sell risk?

"The FOMC statement will be at least as important to assess whether or not the USD rally is over, and whether EM currencies can cheapen more. Q2 GDP was revised up from 2.3% to 3.7%. US growth will average 2.5% this year and inflation will average 0.3%", says Societe Generale.

Fed rate hike conditional for renewed USD strength

Friday, September 4, 2015 3:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom