The need for caution is higher now after the market squeeze post-NFP, which likely leads to a worse positioning backdrop.

"We have generally been inclined to fade the excessive short-term bearishness in EEMEA FX since August (via ZAR and PLN call spreads). The September FOMC was not able to provide lasting relief, but the recent weak NFP data has affected market psychology and the glass appears half full again. Though this fits our bias, critical global uncertainties do remain and we anticipate volatility will persist. Thus risk-reward in the very short term is now less compelling and we anticipate some consolidation around current levels. The October ECB meeting could provide a further impetus for select currencies near term beyond, which the rally will likely stall without further positive surprises", says BofA Merrill Lynch.

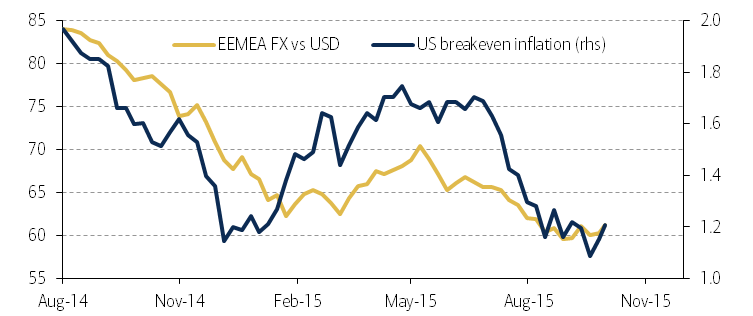

The rally stands so far on one leg-Fed risk-with market pricing of Fed hikes having dropped materially to no hikes in 2015 and only 1-2 hikes in 2016. The missing leg is China risk; for a stable rally with a lasting drop in volatility, sentiment on China has to improve and so far leading indicators are only marginally improved and concerns about CNY reform still remain a tail risk.

"China changed its mechanism for determining central parity on 11 August and most EEMEA currencies are now back to/below the averages (50day) that have prevailed since then. The distance to 100d averages varies from zero to 5% and for ZAR and TRY we expect a pause ahead of that. Compass 30 signals more gains, but not much more for TRY and somewhat more room for RUB",added BofA Merrill Lynch.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks