Given the current elevated pace of employment growth, it is only a matter of time before US wage growth accelerates markedly.

Once the temporary dampening effects of the stronger dollar and the indirect pass-through from lower energy prices have faded, core inflation will climb back to the Fed's 2% target, or possibly even above it.

Capital Economics notes in a report on Wednesday:

- With the labour market still evidently on fire in February, we expect the FOMC statement next Wednesday to omit the language that the Fed can be "patient" in beginning to normalise monetary policy.

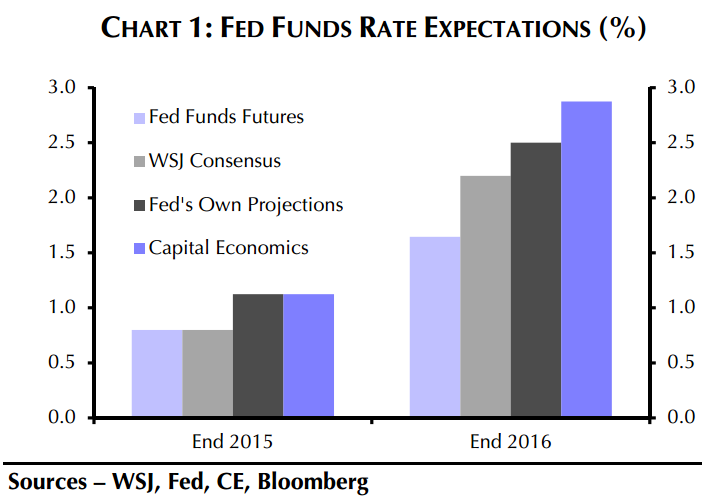

- Even with headline inflation below zero, we then anticipate a first hike in June, with the FOMC pushing the target range for the fed funds rate to 1.00-1.25% by the end of this year and 2.75-3.00% by end-2016, implying mid-points of just over 1% and almost 3% respectively.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX