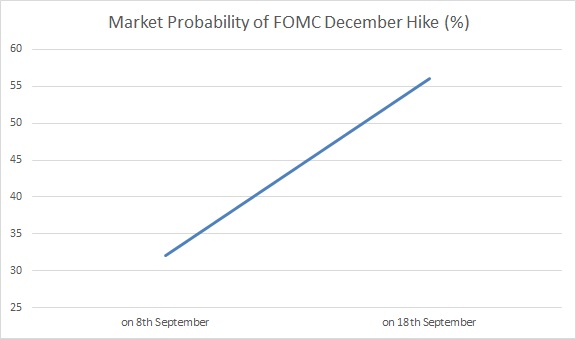

Last week, the media focus was largely on UK inflation report, followed by Bank of England’s (BoE) rare guidance on rates and less attention was paid to the market pricing of hike bets. The financial market’s pricing of hike probability clearly shows the investors are becoming increasingly nervous over inflation. The chart shows how the hike bets evolved dramatically in just matter of days.

On September 8th, the financial market was pricing 68 percent chance that Federal funds rate will remain at 1.125 percent or lower. The market was pricing next hike to be after H1 2018. However, after UK inflation report, showing August inflation quickened to 2.9 percent with core inflation at 2.7 percent was released, followed by U.S. inflation report showing inflation quickening to 1.9 percent in August, the financial market sharply corrected its hike forecast.

The market is currently pricing 56.9 percent chance that the next hike from the Fed will be in December and that is despite dovish commentaries from several FOMC policymakers. This clearly indicates that the market is becoming concerned over inflation and discounting dovish views from the rate-setting committee.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022