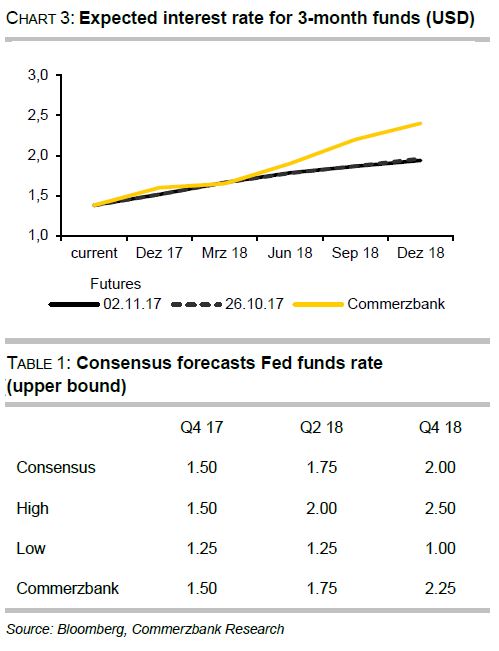

The Federal Open Market Committee’s (FOMC) October 31-November 1 monetary policy meeting brought the expected confirmation of Fed policy. The Fed left its funds target corridor at between 1.00 percent and 1.25 percent. The Fed Funds rate is expected to reach the 2-2.25 percent range by the end of next year, Commerzbank reported.

The statement released after the meeting signaled a more upbeat view of the economic situation. The Fed now sees the economy growing at a “solid” pace despite the impact of the severe storms. The September statement still spoke of “moderate” growth.

The US economy expanded at a rate of 3 percent in both Q2 and Q3. Based on this solid trend in economic activity, the Fed assumes that the labor market will continue to develop positively; the central bank specifically pointed to the further decline in the unemployment rate in September. However, inflation still hovers below the 2 percent mark. While the Fed sees no imminent change on this front, it still assumes that inflation will stabilize at 2 percent over the "medium-term".

The Fed said the risks to the economic outlook are thus "balanced" – a keyword for further policy normalization. All the signs point to a rate hike in December, at the next FOMC meeting, which markets have long expected. This hike would be the fifth rate move in this cycle.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility