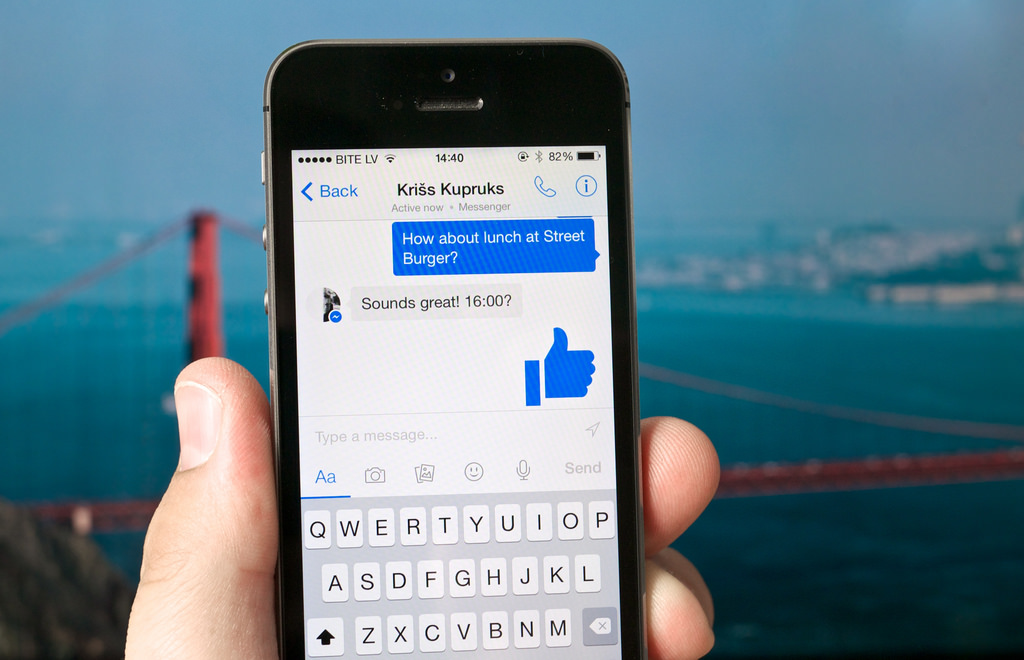

The mobile “Messenger” platform by Facebook attracts users around the world, with Statista placing the active monthly users at over 900 million. This kind of number is difficult to ignore, which is why major banks and businesses are now turning to bots to engage these users as well as to provide them with the online transaction convenience they need.

As Venture Beat explains, Facebook “Messenger” allows users to connect to businesses via online transactions. These businesses will need to create codes pertaining to their brand and embed it in the chat conversation, though, so it’s not like any business will just pop up whenever users type their names. In any case, this practice is already considered much easier compared to other apps that provide the same service in a less efficient manner.

For example, in most cases when a transaction needs to be made, the user would need to activate the banking app, log in their details, click send money or a similar command button, provide the information of the business or person who will receive the money, click submit, and then wait for confirmation. If reading that sentence is cumbersome, slogging through the actual steps is even more annoying to a lot of users.

In comparison, using the Facebook Messenger platform could work by doing something along the lines of typing “Send money to (name)” and then hit send. It’s a one-step system that could prove too appealing to ignore and could revolutionize online banking and buying.

Of course, there’s the matter of security to be concerned about since something so convenient would likely involve hidden code work underneath. The bank information of the user would need to be automatically saved and recalled for one thing, and the same goes for the business or person the user is sending money to.

Another article by Venture Beat also explains how this kind of technology could get annoying via “no-reply” messages from businesses. As such, it’s just a matter of the pros overwhelming the cons.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge