On both hedging and speculation basis, strips at this stage would be best suitable.

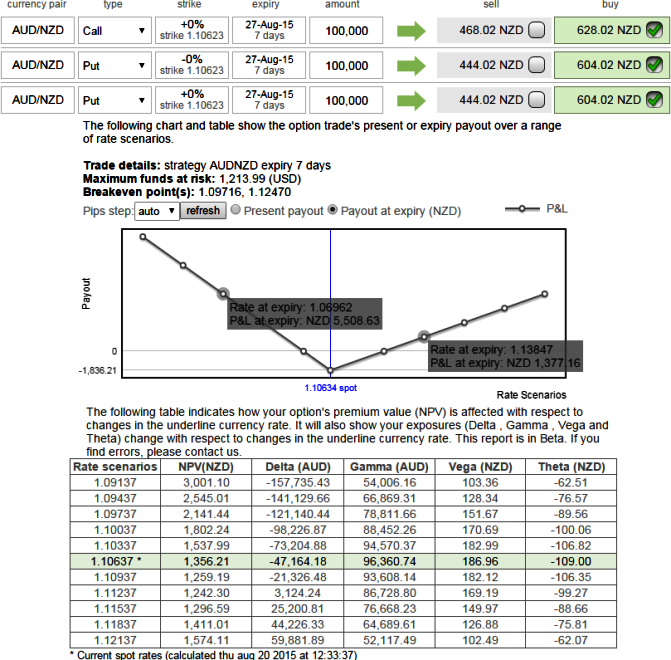

Hold 7D At-The-Money -0.50 delta put and hold one more lot of 15D At-The-Money -0.50 delta put options and simultaneously 15D At-The-Money 0.5 delta call after squaring off 1st put option. The rationale being quite simple in near term the pair may experience slight upswing momentum but we foresee stringent declines in medium term future.

Dear readers, it is all about timing the market so as to follow the trend direction, since this strategy involves buying a number of ATM calls and double the number of puts but the timing of acquiring call would be after the first put attaining its maturity. The strip is more of customized version combination as we maintained less time for call so that the option premiums will have economic pricing and more bearish version of the common straddle.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move. Hence, any hedger or trader who believes the underlying currency is more likely to plunge downside can go for this strategy.

FXWirePro: AUD/NZD calendar strips to serve both hedging and speculation

Thursday, August 20, 2015 7:06 AM UTC

Editor's Picks

- Market Data

Most Popular