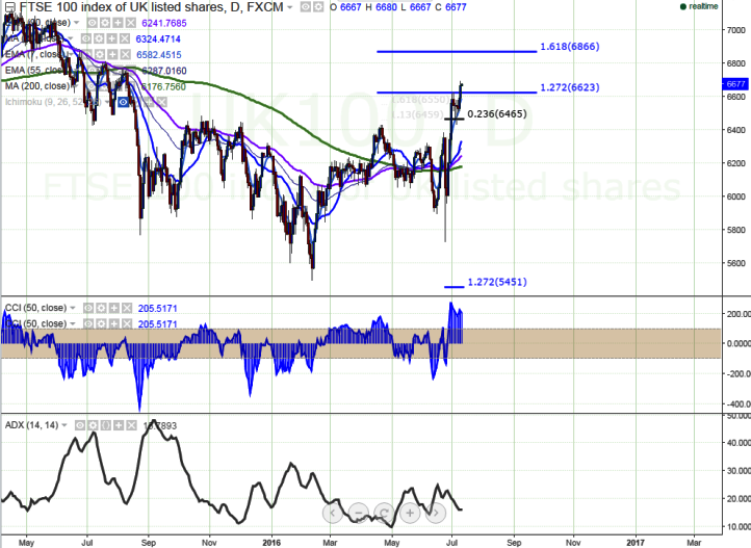

- Major resistance- 6625 (127.2% retracement of 6431 and 5727)

- The index has broken major resistance around 6625 and jumped till 6696. It is currently trading around 6676.

- Minor term trend is slightly bullish as long as support 6513 (7 day EMA) holds.

- On the higher any break above 6625 confirms minor bullishness, a jump till 6866 is possible.

- The minor weakness can be seen only below 6512 and any violation below targets 6465/6405 in the short term.

- Short term trend reversal only below 6430 (Jul 6th low).

It is good to buy at dips around 6635-6640 with SL around 6513 for the TP of 6865