FOMC kept policy on hold, as expected and the Fed policy statement had no major surprises on Wednesday evening. As expected FOMC maintained the federal funds target range unchanged at 0.25%-0.50%. Compared to the last meeting when the decision was unanimous, Fed's George dissented by voting for a Fed hike. As this was one of the small meetings without updated 'dots' and a press conference, focus was on the statement. Nothing in the statement that would suggest that the FOMC is moving away from its forward guidance of gradual rate increases.

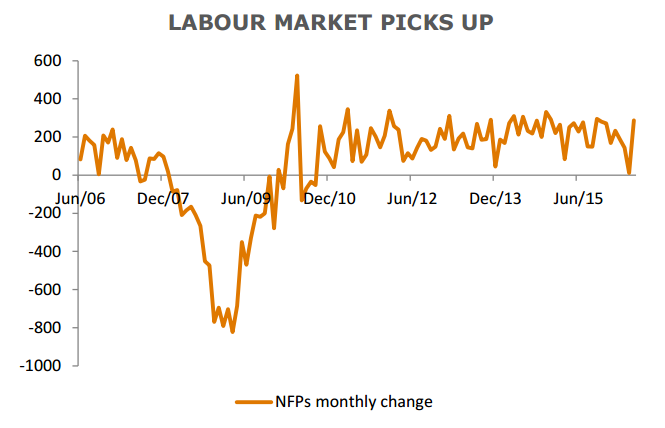

In line with upbeat recent data, the FOMC recognized that the economy grew at a moderate pace in Q2 (especially due to strong consumer spending) and employment growth rebounded in June after the slowdown in April and May. FOMC revised up its economic assessment somewhat, most notable was a new sentence to note that ‘near-term risks to the economic outlook have diminished'.

With the inclusion of this sentence, FOMC leaves the door open for a hike later this year, maybe as early as September. The Committee continues to closely monitor inflation indicators and global economic and financial developments. Should economic data be particularly strong and market developments particularly encouraging, the chances of it raising rates a further time this year will be remote.

US money market rates have recently edged higher after the recent strong numbers and as the US money market reform is moving closer. The message from the FOMC yesterday acknowledging the better labour market numbers could reinforce the tendency for higher money-market rates. Markets will now look to next month’s data and Yellen’s speech at Jackson Hole on August 26 to assess the timing of the next Fed move. The incoming data will decide whether the market will price a more significant probability of a September hike .

Rob Carnell, Chief International Economist at ING Bank explained that reading between the lines, the statement suggests that were it not for these uncertainties, the Fed would be close to hiking rates now, and would probably be ready to do so in September.

The Committee showed no rush in hiking interest rates. The dollar index has quickly retreated to multi-day lows following a more dovish than expected statement on Wednesday. The DXY was down to lows of 96.29 on the day and was trading at 96.60 at 11:45 GMT.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate