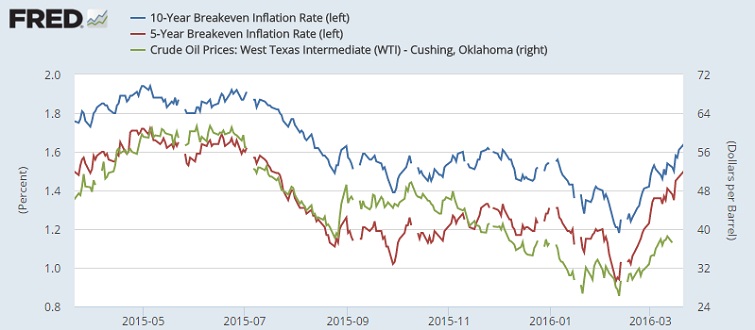

Breakeven inflation rates in United States and around the world are rising, with partial thanks to higher oil price. However, there is probably more to infer from this rising expectations rather than just to consider it as offshoot effects of recent rise in oil price.

- From recent rise in inflation expectations, which rose by 46 basis points since February it is quite evident that oil price is losing intensity of its impact over inflation expectations. That is right to be the case due to lower base effects. Going forward it is more likely that US inflation expectations will rise even if oil stabilizes at current levels. Core consumer inflation, which excludes fuel and food, already breached FED’s 2% target and hovering at 2.3%.

- As of now, 10 year break even inflation is hovering at 1.65%, while 5 year breakeven is at 1.5%. These rates are at highest since summer of 2015.

- Moreover, from the global breakeven inflation rates, we can infer that impact of oil over inflation is not similar to everywhere. In US 60 day rolling correlation between Crude and inflation expectations stand at 55%, whereas it is just 30% for Europe (taking Germany as benchmark).

So, US economy will be more prone to rate hikes, if oil rises from further, whereas Europe will need contributions from beyond oil to boost inflation.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal