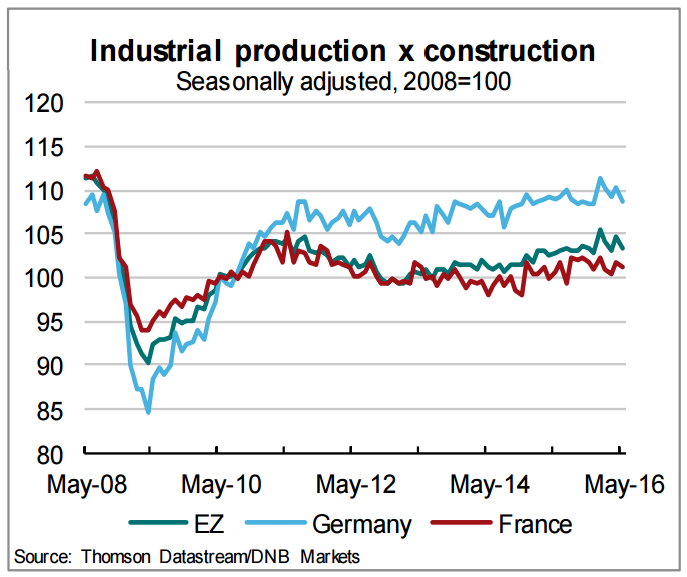

Data released by EU’s statistics agency Wednesday showed that eurozone industrial production fell by 1.2% m/m in May, compared to an upwardly revised 1.4% rise in the earlier month. Compared with May 2015, output was up just 0.5%. Industrial production has now fallen in five of the past seven months, with the three-month trend rate slipping to the weakest since August 2014. Production fell in Germany, France and Italy. The deterioration was broad-based, all main sectors recorded a decrease.

The sharp fall in May reversed almost all of the gains made in the previous month, in a fresh indication that the economic recovery, now in its fourth year, remains modest and vulnerable to new setbacks. Temporary factors like lower energy prices and weak euro have helped, but production has still been sideways. Outlook will be one of subdued growth.

“The potential contraction of the industrial sector in the second quarter, therefore, means the economy is likely to struggle to see anything like the ...expansion of GDP recorded in the opening three months of the year,” said Chris Williamson, chief economist at data firm Markit.

The indications for the second quarter are less encouraging. Data showed that growth was slowing even before the UK voted to leave the European Union on June 23rd. The more than expected drop adds to signs of a second quarter slowdown. The disappointing data follow survey evidence showing business optimism in the currency bloc sliding to the lowest since 2014 as political uncertainty intensified in June.

"After a solid increase in the first quarter of 2016, the industrial output is set for a clear slowdown in the second quarter, confirming our view that GDP growth will decelerate in spring after a strong performance," said Daniel Vernazza, UniCredit.

The euro was little changed following the release of eurozone industrial production data yesterday. On the day, EUR/USD is extending upside, trading at 1.1156 at around 1200 GMT. On the technical side, the pair has broken minor resistance 1.11260, jump till 1.1188/1.1225 is likely.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure