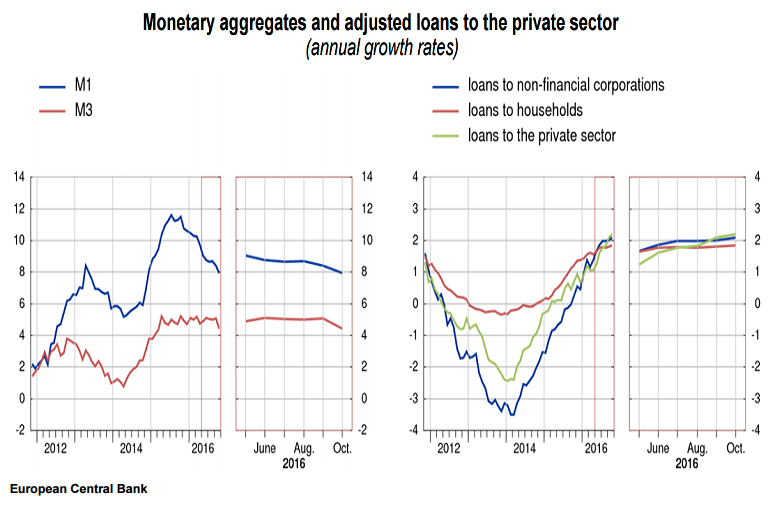

Data released by the European Central Bank on Monday showed that Eurozone money supply expanded at a slower pace, while private sector credit growth improved in October. October annual M3 money supply growth rose 4.4 percent y/y in October from 5.1 percent in September, averaging 4.8 percent in the three months up to October. It was the slowest pace of M3 gains since March 2015.

Annual growth in M1 also declined to 7.9 percent from 8.4 percent previously, while the annual increase in private loans came in at 1.8 percent, unchanged from the previous month. The annual rate of total credit growth however, increased to 4.2 percent from 3.9 percent previously. Details of the report showed annual growth in loans to households held steady at 1.8 percent. At the same time, loans to non-financial corporations gained 2.1 percent versus 2 percent increase in September.

The ECB targets a sustained expansion in money supply and private lending, a crucial component in the central bank's strategy to support growth conditions and boost inflation. The latest data will cause some unease within the ECB. and will add pressure for an aggressive monetary policy and will also tend to increase speculation that the central bank will look to extend the full bond-purchase programme beyond March 2017. There will also be pressure for the ECB to take action to ease financing pressures on the commercial banks and steepen the yield curve in order to underpin underlying profitability.

"The ECB will decide that more stimulus is justified at its December 8 meeting. The bank is likely to extend its asset-buying purchase program by six months to September 2017, or beyond if necessary," said IHS Global Insight Economist Howard Archer.

Later in the session, President Mario Draghi will testify before the European Parliament on the economic outlook of the region and the potential consequences following the Brexit vote, along with speeches of board members J.Dickson, P.Praet and B.Coeure. The Paris-based Organisation for Economic Cooperation and Development (OECD) released its latest global outlook earlier on Monday. In its report, the OECD predicts eurozone growth will remain subdued with some impact from the Brexit vote.

EUR/USD was rejected at session highs at 1.0685 and stood little changed on the day hovering around 1.06 handle at 1200 GMT. FxWirePro's Hourly EUR Spot Index was at 42.368 (Neutral), while Hourly USD Spot Index was at 47.1911 (Neutral) at 1200 GMT.

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock