Last week’s report showed that the inflation rate in the Eurozone quickened. The Inflation rate is set to rise to 1.1 percent in December after rising to 0.6 percent in November. Eurozone’s largest economy, Germany saw inflation quicken to 1.7 percent, while some region reported as high as 1.9 percent. This has already sparked a debate whether the European Central bank (ECB) should cut down on its easing commitments or not, which just in December announced an additional purchase of bonds worth €540 billion.

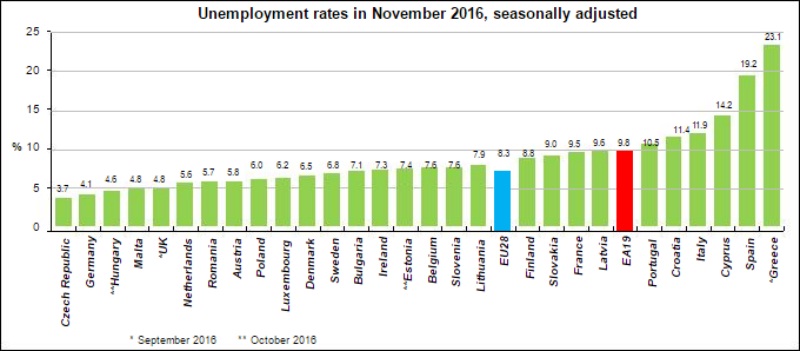

One of the biggest challenges the European Central bank (ECB) faces is the fragmented labor market. Not all labor market across the Eurozone benefited or recovered the same way since the debt crisis of 2011. Today’s unemployment report showed that the unemployment rate at 9.8 percent, 7-year low. But, while German unemployment has declined to post-reunification low of 4.1 percent, the unemployment rate in Greece remained at 23.1 percent. The unemployment rate even in the third and fourth largest economy of the Eurozone; Italy and Spain are as high as 11.9 percent and 19.2 percent.

The biggest risk ECB runs is the deterioration of economic condition in these economies, if it is forced to raise rates amid a quickening of inflation.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election