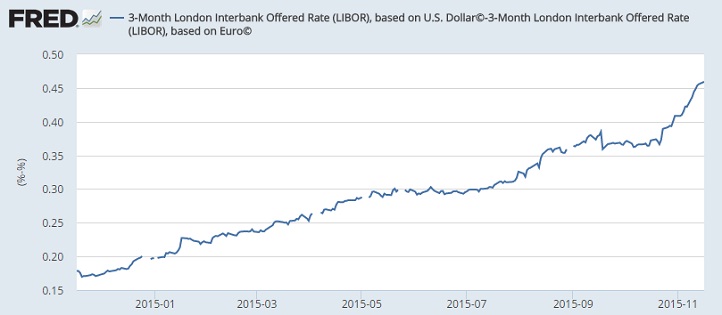

London Interbank Offered rate or Libor spread between 3 months USD and Euro is at highest level since 2007, which comes as a little surprise given the rise in divergence between two economies' monetary policies.

If all stays well from here, European Central Bank (ECB) will use all instruments within mandate, possible a combination of lower deposit rates and increase in asset purchase program's tenure and pace next week to support Euro zone's economy as well as bring back inflation.

On the other hand, if all stays calm, US Federal Reserve will finally deliver much awaited and anticipated 25 basis points rate hike in its meeting mid-December.

We at FxWirePro, stays firmly with our call for Euro/Dollar parity by end of year or 1st quarter next due to this big divergence.

We expect inflation to return globally rather than in economic regions, so the divergence or the gap in policy is likely to last for longer. We expect further divergence, as ECB is likely to keep policy accommodation in place much longer. Simple reason is that, in spite of improved growth in regional economies such as Spain, Ireland, overall Euro zone growth is still timid and unemployment is at very high around 10.8%.

We add to our Euro/Dollar expectations, further divergence in Libor. 3 month Euro/Dollar Libor spread is at 0.45%.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand