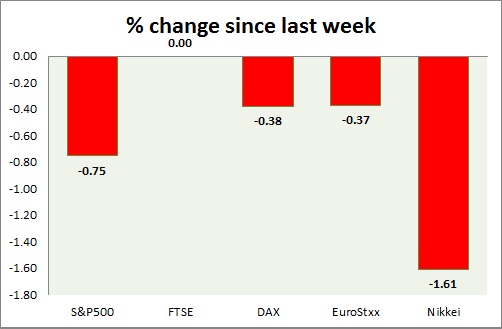

Equities are again trading in red today. Performance this week at a glance in chart & table.

S&P 500

- S&P future is down as risk aversion hits market hard over slowdown in China. Today's range 1970-1916.

- ISM manufacturing PMI dropped to 51.5 in August.

- TIPP economic optimism for September dropped to 42 from 46.9 prior

- S&P 500 is currently trading at 1934. Immediate support lies at 1900 and resistance 1960.

FTSE -

- FTSE opened in deep negative as index was closed over holiday yesterday. Today's range 6250-6025.

- FTSE is currently trading at 6050. Immediate support lies at 5950 and resistance 6600.

DAX -

- DAX is sharply down today, as risk aversion over China hits again. Today's range 9930-10240.

- DAX is currently trading at 10010. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are trading in red today.

- Germany is down (-2.5%), France's CAC40 is down (-2.60%), Italy's FTSE MIB is down (-2.25%), Portugal's PSI 20 is down (-2.65%), Spain's IBEX is down (-2.85%).

- Euro zone unemployment rate dropped to 10.9%, lowest in more than 3 years.

- EuroStxx50 is currently trading at 3190, down by -2.25% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei is worst performer this week as stronger Yen is providing headwinds. Today's range 18470-19070.

- Nikkei is currently trading at 18040, with support around 16000 and resistance at 19500.

S&P500

-2.86%

FTSE

-2.97%

DAX

-2.71%

EuroStxx50

-2.80%

Nikkei

-5.84%

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate