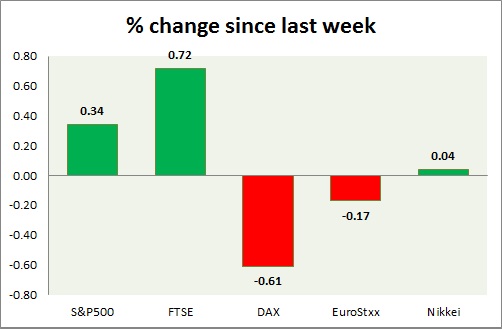

Equities are all trading in green today as bargain hunters jumped into the market. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is up today, as risk off sentiment failed to gain much ground. Today's range 2093-2068.

- S&P/ Case-Shiller home price index showed, house prices rose by 4.9% In June.

- Preliminary reading showed Markit services PMI rose to 55.2 from 54.8 prior.

- Richmond FED manufacturing index rose to 13 from 7 prior.

- Consumer confidence dropped to 90.9 in July.

- S&P 500 is currently trading at 2093. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE gained as economic outlook improved. Today's range 6590-6490.

- GDP is expected to grow at 0.7% in second quarter.

- FTSE is currently trading at 6590. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is up today as risk on sentiment improved. Today's range 11250-11000.

- DAX is currently trading at 11220. Immediate support lies at, 10500-10600 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are all trading in green as risk aversion subsided. However Portugal stocks are negative.

- Germany is up (+1.06%), France's CAC40 is up (+0.80%), Italy's FTSE MIB is up (+2.3%), Portugal's PSI 20 is down (-0.4%), Spain's IBEX is up (+0.86%)

- EuroStxx50 is currently trading at 3570, up by +1.7% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is up today, however seems to be struggling.

- Stronger Yen posing headwinds.

- Nikkei is currently trading at 20370, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.34% |

|

FTSE |

+0.72% |

|

DAX |

-0.61% |

|

EuroStxx50 |

-0.17% |

|

Nikkei |

+0.04% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary