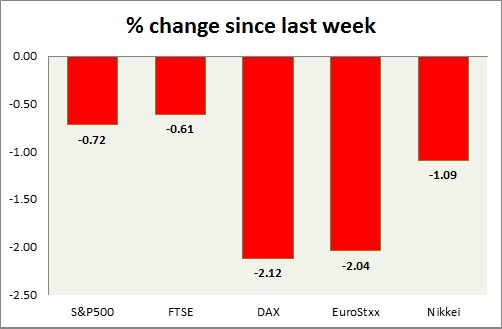

Equities are all trading in red today as risk off sentiment returned over Chinese sell offs today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down today, as Chinese stocks dropped by 8.5%. Today's range 2087-2063.

- US durable goods order rose by 3.4% in June but only 0.8% excluding transport.

- S&P 500 is currently trading at 2070. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE after initial fight back, joined global equities in sell offs. Today's range 6590-6490.

- CBI report showed deterioration in UK's manufacturing sector.

- FTSE is currently trading at 6503. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is sharply down today as Euro gained. Today's range 11770-11580.

- German IFO business climate rose to 108 along with other indicators. Import prices dropped by -0.5% in June.

- DAX is currently trading at 11050. Immediate support lies at, 10500-10600 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are all trading in red today over risk aversion.

- Germany is down (-2.6%), France's CAC40 is down (-2.40%), Italy's FTSE MIB is down (-3.1%), Portugal's PSI 20 is down (-1.75%), Spain's IBEX is down (-1.30%)

- EuroStxx50 is currently trading at 3510, down by -1.75% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is down today, joining global sell off amid Chinese rout.

- Stronger Yen and global equity sell off pushed the index future lower in New York session.

- Nikkei is currently trading at 20140, with support around 20000 and resistance at 21000.

|

S&P500 |

+0.14% |

|

FTSE |

+0.21% |

|

DAX |

+0.44% |

|

EuroStxx50 |

+0.49% |

|

Nikkei |

+0.00% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand