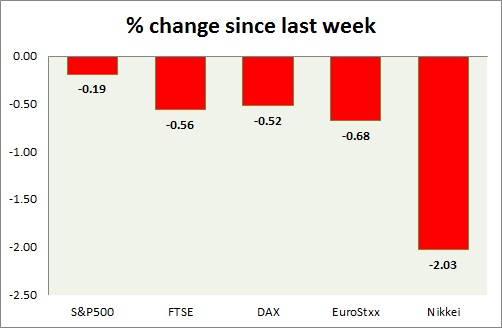

Equities are pairing losses after massive loss since last week. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is up today, looking to move above 2100 mark. Today's range 2092-2081.

- Weak dollar providing support to the index as risk aversion subsided.

- S&P 500 is currently trading at 2090. Immediate support lies at 1980, 2040 and resistance 2164.

FTSE -

- FTSE is bouncing back from support. Today's range 6783-6734.

- FTSE is currently trading at 6782. Immediate support lies at 6700 and resistance at 7120.

DAX -

- DAX is bouncing back after completing 11% correction from high. Greek debt drama and rising bund yields remain concern

- DAX is likely to move towards 10550 area, since 1100 mark was broken. However DAX remains fundamental buy.

- DAX is currently trading at 11132. Immediate support lies at 10500 and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are all trading in green today. Risk aversion subsided.

- Germany is up (+1.1%), France's CAC40 is up (+0.55%), Italy's FTSE MIB is up (+1.42%) and Spain's IBEX is up (+0.43%).

- EuroStxx50 is currently trading at 3487, up 1.45% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Nikkei remains worst performer today as bank of Japan's (BOJ) Governor Mr. Kuroda suggested Yen level to be weak enough and shrugged off the possibility of further weakness.

- Nikkei is currently trading at 20140. Key support is at 19500 and resistance at 20900 area.

|

S&P500 |

-0.19% |

|

FTSE |

-0.56% |

|

DAX |

-0.52% |

|

EuroStxx50 |

-0.68% |

|

Nikkei |

-2.03% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings