Bets on reversal of recent expansionary monetary policy has led to quantitative tightening across the world, especially across emerging economies.

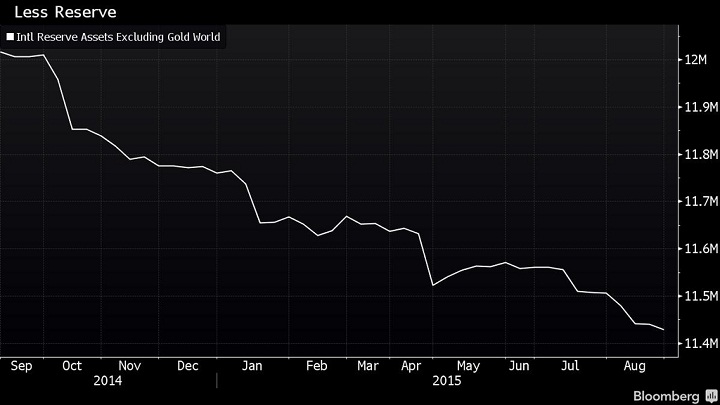

- According to latest data from International Monetary Fund (IMF), global reserve across central banks are in decline, especially across emerging markets. As per latest data reserves has fallen quite rapidly over the past year from their peak of 11.98 trillion to 11.43 trillion as of August leading to a quantitative tightening.

What's causing reserves to decline?

The reasons are multiple.

- Recent decline in oil prices has led oil exporting emerging economies use their reserves to gap budget deficit and trade deficit.

- Many emerging market economies have used up reserves to defend their currencies, as dollar flies out of their economy.

- Rate hike bets by developed market economies has led to reverse of portfolio inflows into emerging markets, which has also contributed to the drop.

We expect reserves to decline further as US FED and Bank of England (BOE) prepares to hike rates and commodities decline.

The sharper the decline, the more trouble it is going to cause for vulnerable economies.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate