EURJPY declined more than 250 pips from a minor top of 177.938 on board-based US dollar weakness. It hits an intraday low of 175.35 and is currently trading at approximately 175.72. Intraday outlook remains bearish as long as the resistance at 178 holds.

Rising marginally from 37.3 the previous month, Germany's ZEW Economic Sentiment Index reached 39.3 in October 2025—the highest since July's 52.7 peak but Financial experts voice restrained optimism for medium-term recovery despite worldwide uncertainties and sluggish state spending, so missing projections of 40.5–41.0. Conversely, far below predictions, the Current Conditions Index dropped 3.6 points to a May low of -80.0, emphasizing increasing current conditions such as slow domestic demand. Sectoral projections diverged; export-heavy sectors like metals, pharmaceuticals, mechanical engineering, and electrical equipment showed robust recoveries, while automotive sentiment slightly worsened in light of EV. Eurozone expectations also declined to 22.7 on French budgetary concerns, along with trade risks and transitions. Among the main challenges are US tariffs, China's weakness, and political turmoil; these help to confirm worries that Germany's economic problems—linked to trade slumps, inflation, and structural problems—could persist and necessitate a strong policy reaction for the biggest European economy.

Technical Analysis:

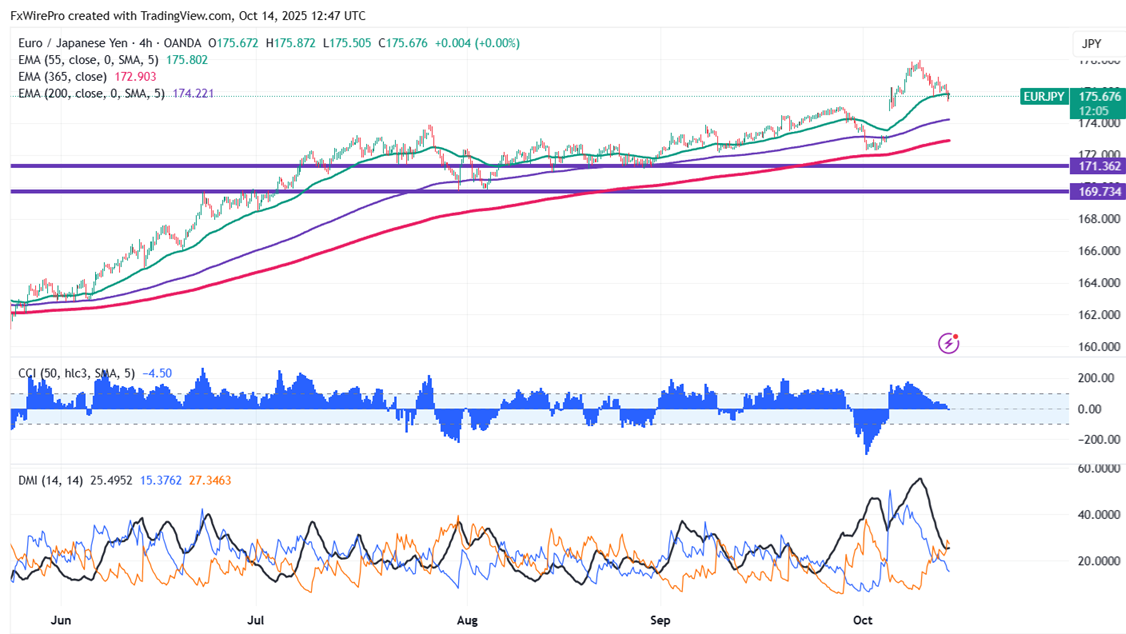

The EUR/JPY pair is trading below 55 EMA, above 200 and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 176,a breakout here could lead to targets at 176.80/178.

- Immediate Support: At 175, if breached, the pair could fall to 176/175/173.78/173/171.80/170.80/169.70.

Indicator Analysis (4-hour chart): - CCI (50): Bearish

- Average Directional Movement Index: Bearish. Overall, the indicators suggest a Bearish trend

Trading Recommendation:

It is good to sell on rallies around 175.95-176 with a stop loss at 177 for a TP of 173.78/173.