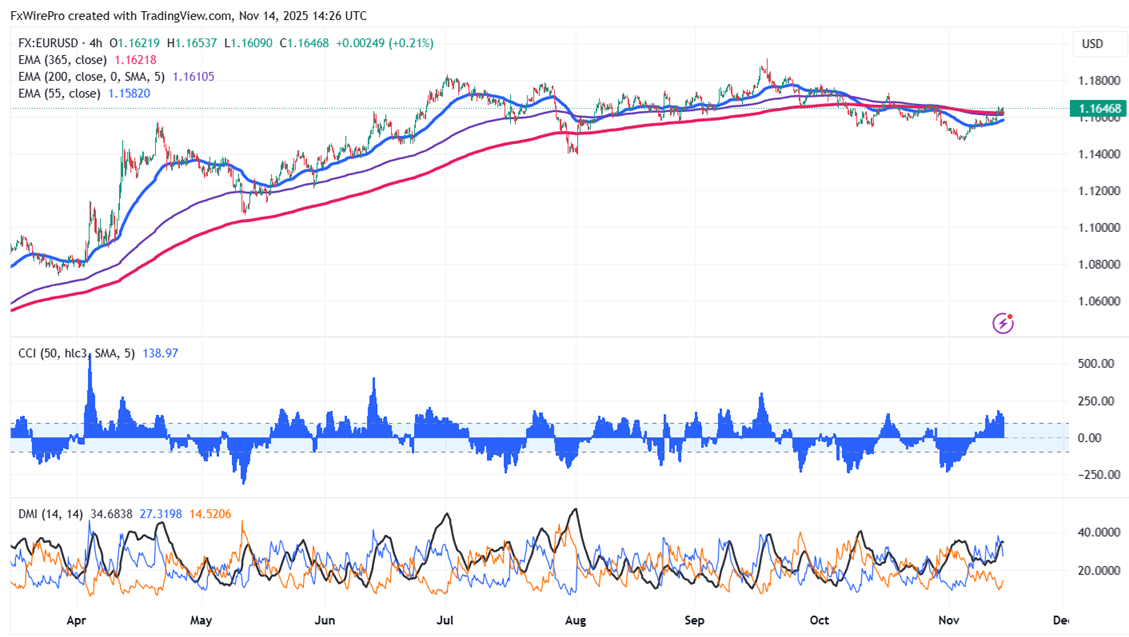

EUR/USD took support near 55-4H EMA and showed a nice pullback. It hits an intraday low of 1.16090 and is currently trading around 1.16521. Intraday trend remains bullish as long as support 1.1580 holds.

The pair is holding above the 55 EMA, 200 EMA, and 365 EMA in the 4-hour chart. Near-term resistance is seen at 1.1660, a break above this may push the pair to targets of 1.1700/1.1765/1800/1.1835/1.1850/1.1920. On the downside, support is seen at 1.1560; any violation below will drag the pair to 1.1500/1.1435/1.1400.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Bullish

It is good to buy on dips around 1.1600 with a stop-loss at 1.1545 for a target price of 1.1765/1.1800.