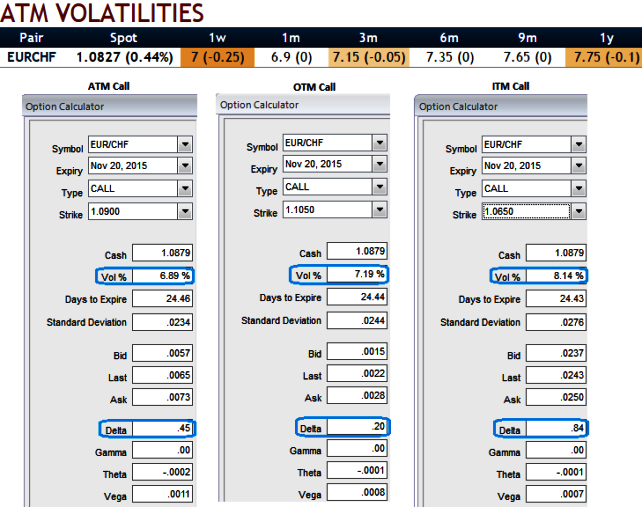

In a true smile, options with an at-the-money strike are priced with a lower volatility than out-of-the-money and in-the-money volatility strikes. Such market occurrences are observable in the EURCHF FX OTC market.

For instance, suppose we've constructed an at the money call option of EURCHF with this month expiry and with this given maturity has an implied volatility of 7% (6.89% to be precise, and that its delta amounts close to 50%.

We ponder now with an another call option with the same maturity on the same pair is priced with an implied volatility of 7.15% but its strike is 2% out of the money (strike at 1.1050) and while its delta is just shy of 20%.

Furthermore, let's contemplate a 3rd option with a strike in the money strike and a delta of 80% is also priced with a volatility of 8%.

On a 1-3m horizon, our target for this pair is still higher though we have adjusted our Q4 forecast (at 1.10) but certainly not with steep moves. Fundamentally, the latest quarterly SNB meeting also did nothing to change the currency outlook.

The inflation forecast was revised lower again in the near-term (on lower energy prices) though the long-term forecast was little changed.

Although EUR/CHF reached a new post-floor high in the beginning September (at 1.1049), the pace of appreciation is painfully slow, Infact the fluctuation has been softened.

We have positioned for higher EUR/CHF in options with a risk reversal but the long tenor (1y at entry, expiring July 2016) shows how long we expect this process to take.

EUR/CHF creeps up with snail’s pace - volatility smiles suggest ATM instruments

Tuesday, October 27, 2015 1:57 PM UTC

Editor's Picks

- Market Data

Most Popular