Potential for a Fed rate rise in April appears to have been put to rest after Yellen's speech at the Economic Club of New York on Tuesday. Taking a different approach from other Fed officials, who had earlier suggested hike rates as early as April, US Federal Reserve Chairperson Janet Yellen on Tuesday said that the US central bank should move cautiously in raising interest rates.

Latin American currencies had fallen after opening on Tuesday, on fears that Yellen could reinforce the Fed's intention to raise rates sooner rather than later, a move which could drain capital away from high-yielding emerging markets. But, erased earlier losses, following comments by Federal Reserve Chair. While market concerns over the yuan’s sharp depreciation and the Fed’s tightening fade away, portfolio inflows could boost demand for EM Asian financial assets such as equities and currencies in the coming weeks.

According to Institute of International Finance (IIF), estimated nonresident portfolio flows to emerging markets surged to a 21-month high of USD 36.8bn in March on the back of dovish central banks, a return of risk appetite, and bargain hunting by global investors. EM Asia attracted USD 20.6bn in March, followed by Latin America with USD 13.4bn.

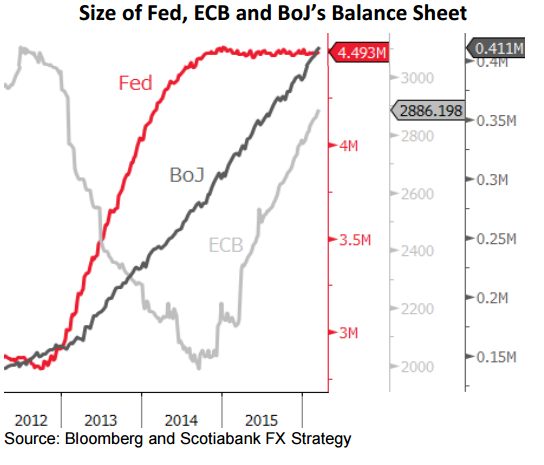

"In the coming months, we believe EM Asian currency and equity markets will be majorly driven by the Fed’s tightening path and cross-border portfolio flows given a relatively steady yuan basket. Meanwhile, oil prices and “Brexit” uncertainty could fluctuate market sentiment intermittently." said Scotiabank in a report.

Markets likely to keep focus on U.S. wage growth due Friday for early signs of the prospect for inflation. EM regional currencies are likely to decline versus the dollar in response to any resurfacing fears about the Fed’s tightening in the run-up to June FOMC meeting. While Yellen’s comments have seemingly put an end to an April move, the US dollar’s decline could be limited if Friday’s payroll report surprises on the upside.

"We expect the Easter effect to have a negative impact on the headline employment figure. We see the pace of hiring slowing to 180k from 242k in February, a flat unemployment rate at 4.9% and a trend-consistent 0.2% m/m gain in average hourly earnings," said BNP Paribas in a report.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand