European Central Bank's (ECB) smaller than expected monetary stimulus, wiped out billions of Dollars from bond market worldwide as investors rush for exits, from the most overcrowded trades of the year.

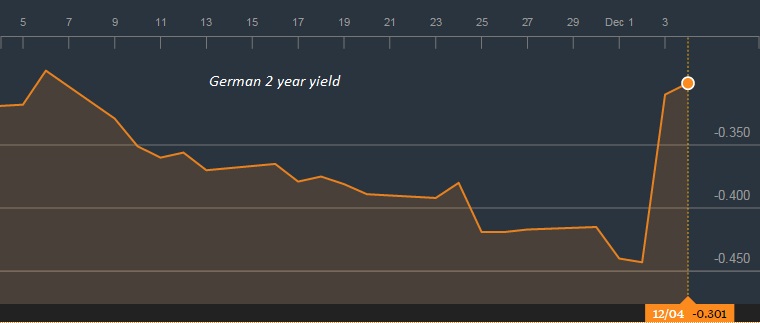

After, last meeting in October, investors just kept pumping money into long bond trades across Eurozone, that pushed German 2 year yield to as low as -0.45%, whereas ECB deposit rate was at -0.20%. Investors were clearly expecting an increase in pace of purchase (which wasn't just there) couple with around 15 basis points rate cut (it was just 10 bps).

By end of day, German 2 year yield was up more than 30%, trading just below the deposit rates. Today it is up by another 2.9%, trading at -0.3%. German 10 year yield jumped 20 basis points by end of day to trade at -0.67%

Bloomberg business pointed out more than $100 billion got wiped out from Euro area's bond market alone and the number could be higher than $300 billion. Global index of bonds, compiled by bank of America Merrill Lynch, dropped at sharpest pace in 2 years.

Though majority of the adjustment is done, there could be more since further stimulus hope has significantly diminished. However violent moves like these, less likely.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal