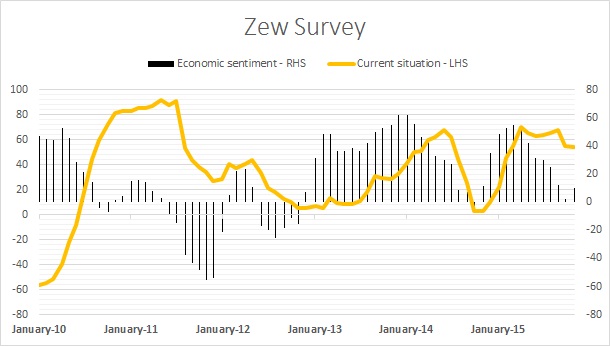

European Central Bank's (ECB) easing hint is doing its magic again through business community, which this have already been enjoying weaker Euro and improvement in domestic demand. Moreover, European Banks' survey indicated that banks are likely to use the additional fund from ECB's asset purchase program into lending and further cut in deposit rates would ease already declining interest rates further.

In Zew president, Professor Clemens Fuest's own words - "The outlook for the German economy is brightening again towards the end of the year. Economic pessimism appears not to have increased after the terror attacks in Paris. The currently high level of consumption in Germany, the recent decline in the external value of the euro, and the ongoing recovery in the United States are likely to bolster the robust development of the German economy."

In spite of recent turmoil and slowdown in global trade, it is more likely than not, that European bourses would perform better than their global market peers.

European blue chip index is currently trading at 3430, up 0.9% today and close to 10% for the year, compared to -0.5% YTD decline in S&P500.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings