When the ECB launched its €1.1trillion QE programme in March, purchasing €60bn of bonds a month, euro area inflation stood at a minus 0.1pct and has since climbed to 0.1pct, well below the ECB target. In a speech last week European Central Bank president Mario Draghi said that there was little turnaround for core inflation, and trends were continuing to weigh inflation down. The renewed decline in oil and commodity prices and its impact on inflation is having a negative effect on inflation expectations which could make bringing inflation back up to the target more difficult.

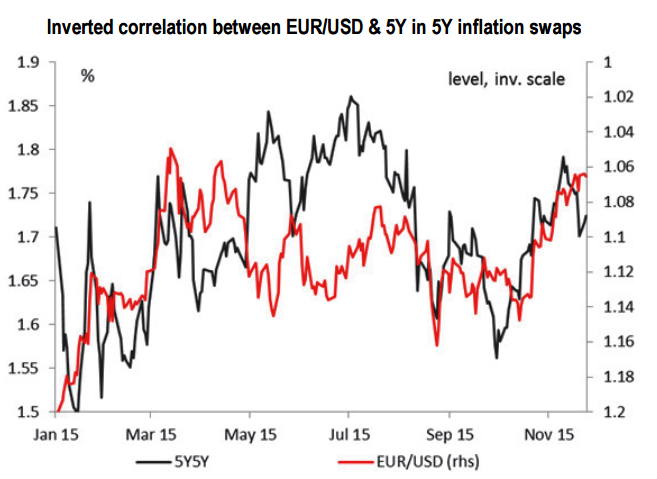

ECB minutes at the last meeting revealed the banks' concerns regarding the capacity to bring back inflation closer to the 2.0% target and highlighted uncertainties regarding the magnitude of the output gap and the potential deanchoring of inflation expectations, which still remain too low. In such a situation, depreciation of the euro could be seen as the only quick option to strengthen "the reflation scenario". According to the ECB's macroeconomic model, a 10% drop in the EUR/USD could help to boost Eurozone inflation by around 0.6% over a two year horizon. Furthermore, the past year has shown an inverted correlation between inflation expectations and the EUR/USD.

Markets now opine that a lower exchange rate has become a key instrument to boost inflation expectations with, in view of the ECB minutes, the willingness to reach a possible target on 5Y in 5Y inflation swaps closer to 1.9% vs. around 1.75% currently. The extent of the ECB's downward revision to inflation in its new macroeconomic forecasts will be key in assessing the level of monetary stimulus needed to push down the euro.

Mario Draghi, the ECB's president, has given strong signals that more monetary firepower is on the way. Soft inflation readings for the euro zone on Monday and Tuesday may strengthen expectations for ECB action at its Dec. 3 meeting, but whatever the outcome, an easing appeared to be fully factored in. The ECB could expand QE beyond September 2016 to possibly March or June 2017 and increasing the amount being purchased each month from €60 bn currently to possibly €70/€80 bn. While the ECB's initial target was to increase its balance sheet by €1 tr, the ECB president could now announce a target between €1.5 & €2 tr.

The ECB could also opt to cut the deposit rate to anchor short term rates at very low levels. In view of recent comments from the ECB president to adjust the deposit rates accordingly with inflation to avoid any rise in real rates, this cut could reflect the downward revision of the 2017 inflation forecast, so possibly around -0.2%. Lastly, we can never rule out the possibility that the ECB could also opt to do less in favour of relying on Fed policy to push down on the EUR in an attempt to keep some ammunition in its monetary arsenal.

"If weakening the euro to spur reflationary pressures is the target, the stronger the ECB's action, the better! However, while cutting the deposit rate and expanding QE beyond September 2016 seems to be the most logical step to take against a backdrop of weaker medium term inflation projections, there is a risk of expecting too much from the ECB", says Scotiabank in a research note.

The prospect of further stimulus this week from the European Central Bank drove the euro to its lowest since April. The euro fell a third of a percent to $1.05645 against the Greenback, below last week's low of $1.0565. Against the yen, the euro was trading at 130.05 as at 1140 GMT.

ECB expectations adding pressure on euro

Monday, November 30, 2015 11:56 AM UTC

Editor's Picks

- Market Data

Most Popular

China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed