Canadian economy started 2016 on a strong footing, growing 0.6 percent q/q in Q1. However, it was unable to sustain the strong momentum into Q2. Oil production downtime caused by the wildfires was the main drag. That said, going into the third quarter, as production has now resumed the economy is expected to pick up again. Moreover, growth should be supported by the reconstruction work in the province of Alberta affected by the wildfires as well as a more expansionary fiscal policy.

"The economy will recover notably in Q3. We expect a rise of roughly 1 percent q/q, as does the Bank of Canada (BoC). All-in-all, that would mean that the Canadian economy remains on a robust growth path." said Commerzbank in a report.

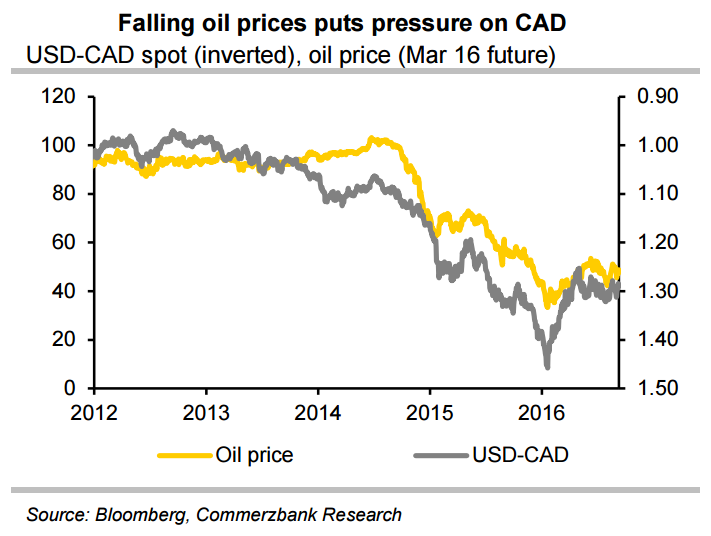

BoC still needs a comparatively weak CAD to support the competitiveness of domestic companies and to fuel foreign demand. Drop in the oil prices have dragged CAD lower. Since mid-January, CAD has been able to regain some ground against the US Dollar as a result of a recovery of the oil price. Also, reduced Fed rate hike bets following growth concerns in China, weak US economic data and the surprising Brexit referendum result have supported CAD against the USD.

As of now, ongoing uncertainty over the US interest rates outlook amid a slew of mixed Fed speaks, has left the markets confused. But economists remain optimistic and expect the next Fed rate hike for December 2016. As a result, USD-CAD is likely to trend higher towards year-end making things easier for the BoC. USD/CAD trading 0.53 percent higher on the day at 1.3112 at around 09:30 GMT, while US oil was down 1.29 percent at 45.10.

"The BoC will wait for quite some time yet before normalising monetary policy. The prospect of a first rate hike is likely to emerge at the end of 2017 at the earliest. Only then will CAD appreciate notably and on a sustainable basis against USD." said Commerzbank in a report.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings