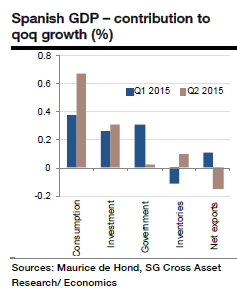

Spain household consumption (contributing for two-third of the Q2 growth number) continued to benefit from low interest rates (as the bulk of mortgage debt is in variable rates), low inflation, the ongoing tax reform and the improving labour market. INE is likely to confirm the 1.0% qoq GDP growth in Q2, says Societe Generale. The details will show that domestic demand explains the bulk of the growth in Q2.

Favourable financial conditions and lower taxes also supported the country's investment together with improved demand prospects. Net export is expected to have been broadly slightly negative in Q2. However, after a very strong H1, H2 and 2016 GDP growth is expected to slow down significantly - as many temporary factors (negative inflation in particular) will recede, says Societe Generale in a research note on Thursday.

On top of that, as both corporate and household indebtedness remain close to their pre-peak levels, the de-leveraging process is not over. As a result, the recent strong consumption and investment growth do not appear sustainable, adds SocGen. Finally, with the Catalonian regional elections in September and the national elections in late November, risks of political stalemate, uncertainty and lack of reform are elevated, weighing on businesses' hiring and investment decisions.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks