The ECB clearly disappointed markets on several fronts with its bare-minimum easing package. The decision though not unanimous was taken by a "very large majority". ECB may have under delivered but delivered nonetheless. The elements announced were as follows:

A lower deposit rate (-10bp to -0.3%), Asset purchases will be extended until the end of March 2017 or longer, Inclusion of local and regional government debt in EUR, Principal payments will be reinvested, Full allotment procedure in refinancing operation will be continued at least until the end of 2017.

The ECB action sent Euro shorts scrambling for cover, bond yields spiked and equities were sent into a tailspin. It was obviously not all that the ECB would do at this point. The ECB definitely still has an easing bias. The message from the ECB is that very easy monetary policy will be around for a very long time. Draghi also stressed the flexibility of the asset purchase programme.

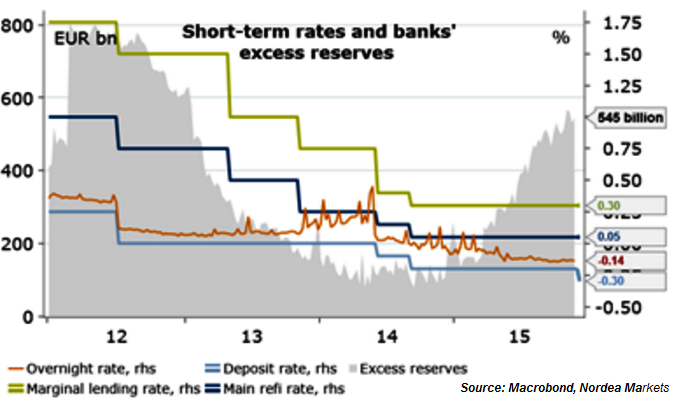

The policy rate corridor is now asymmetric with the marginal lending rate 25 bp above the main refi rate and the deposit rate 35 bp below. The practical relevance is limited as overnight money is trading closer to the deposit rate because of excess liquidity.

"The overall purchase volume in the QE programme will rise from EUR 1,140 bn to EUR 1,500 bn or by almost one third or 3½% of GDP. While not insignificant, it's not a whole new world, especially as few were expecting the purchases to end next year. In fact, we find it unlikely they could buy EUR 60bn in one month and nothing the next, so eventually a tapering process will be needed", says Nordea Markets Research.

The biggest reason why the ECB did not do more was probably attributable to recent rebound in inflation expectations despite continued fall in oil prices, which Draghi also noted. Now, if the rebound in inflation expectations is not sustainable, the ECB could quickly find itself in a position of needing to do more.

"Based on Draghi's message, a further cut in the deposit rate would probably be the easiest next step for the ECB, while an increase in the monthly pace of the purchases would be a bigger step. The ECB wants to keep all doors open", adds Nordea.

A massive EUR shorts squeeze on Thursday pushed the Euro to 1.0981 against the Greenback, the biggest one-day surge in the pair in nearly seven years. EUR bulls faced some exhaustion in Asia, after witnessing almost 450 pips rally in the previous session. The pair is trading at 1.0884 as of 1155 GMT. More volatility likely as markets now brace for the US non-farm payrolls data due in the NY session.

Does the ECB still have an easing bias?

Friday, December 4, 2015 12:33 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary