The European Central Bank (ECB) will decide on December 8 on whether and how to extend its 80 billion euros ($85 billion) monthly bond purchases and expectations are for the programme to continue beyond its current March deadline. Two of the top officials said earlier this week that the ECB needs to continue supporting the euro zone economy with its ultra-loose policy, cementing expectations for an extension of the ECB's bond-buying scheme next month.

Euro zone inflation was 0.5 percent last month and is expected to rise beyond 1 percent early next year, mainly due to a stabilisation in oil prices. However, the ECB is still a long way off its inflation target of almost 2 percent.

Analysts are not very hopeful that the economic environment or the core inflation trend in the eurozone will improve notably. President Mario Draghi also told a European Parliament committee on Monday the ECB needed to maintain its current level of monetary support to bring euro zone inflation back to its target.

"The ECB will be forced to get active again and will prolong the deadline of the asset purchases beyond March 2017 for another six months. Our experts do not expect another cut of the deposit rate, though," said Commerzbank in a report.

The US economy rose by a solid 2.9 percent q/q (annualised) in Q3 and the unemployment rate is lingering at 5 percent. Inflation stood at 1.5 percent y/y and the Fed’s preferred mean for core inflation, the PCE index, at 1.7 percent. Based on improving fundamentals, the Fed signalled an imminent rate hike at its October meeting. At its November meeting, he Fed refrained from hiking the key rate ahead of US presidential election on 8th November, but repeated the strong indication for a hike.

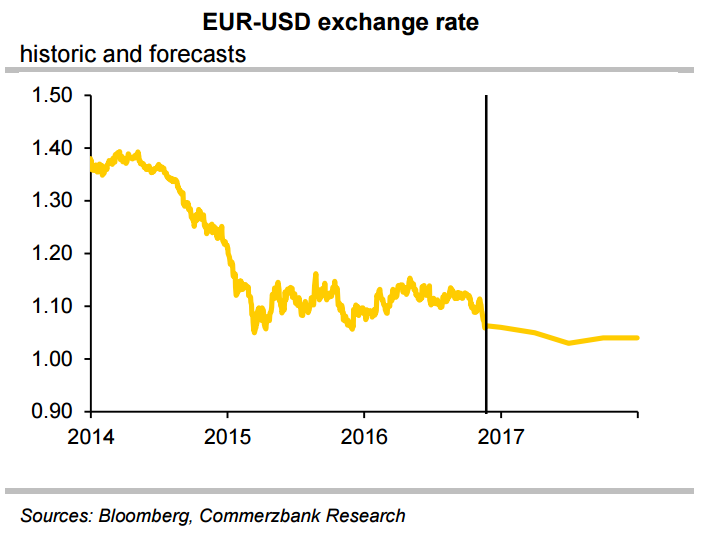

Donald Trump' victory has raised US interest rate expectations markedly. Trump's expansionary fiscal and protectionist trading policy are likely to boost the USD and drive up inflation. A rate hike in December is now almost fully priced in by markets. The market has also come to attach a likelihood of over 50 percent to two additional Fed rate hikes in 2017.

Fed will keep hiking interest rates whereas the ECB will stick to its expansionary stance. With Fed and ECB monetary policies diverging further, EUR/USD is likely to remain subdued. By end-2017 the ECB will be forced to gradually stop buying bonds as it will gradually run out of eligible assets. This should support the euro against the US dollar by the end of 2017.

EUR/USD was trading at 1.0620 at around 1210 GMT as markets await FOMC minutes due later in the NY session. At the same time, FxWirePro's Hourly USD Spot Index was at 32.9119 (Neutral) and Hourly EUR Spot Index was at 69.1643 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook