Euro has remained relatively resilient, despite a substantial deterioration of the situation in Greece. Although Grexit risks are negative for the Euro, data and divergence of monetary policies are more important drivers. Improving US data and diverging monetary policies to weaken the Euro by the year-end

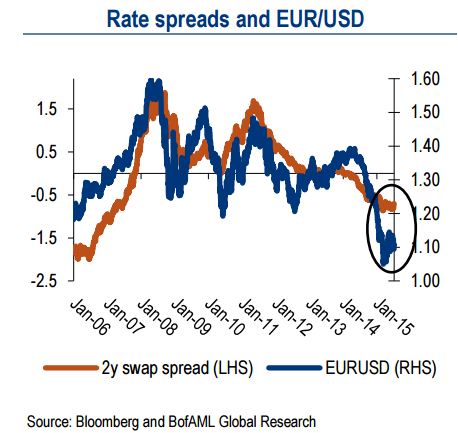

Relative data surprises have recently started turning in favor of the US, but are still consistent with a stronger Euro. Short-term rate differentials would also justify EUR/USD well above current levels.

"We project EUR/USD at parity by the end of the year, expecting the first Fed rate hike in September and low Eurozone inflation to keep the ECB's QE commitment strong. Greek risks, negative Bund net supply and light positioning also pose short-term EUR risks." says BofA Merrill Lynch in a research note.

The introduction of Greece capital controls and the 'No' vote in the referendum have weakened the Euro, but the impact was smaller than many investors may have expected. The Euro will weaken in response to Greek risks only if periphery rates and European equities sell-off substantially

"We still believe that Grexit will be negative for the Euro, although we don't necessarily expect a sharp adjustment." notes BofA Merrill Lynch

The dovish Fed and the not dovish-enough ECB have been more important EUR/USD drivers. This does not necessarily suggest that the Euro will not weaken during Grexit. Indeed, the ECB will be more likely to ease policies further in response to Grexit, than the Fed to postpone its first rate hike.

EUR/USD currently trades at 1.1025, down around a third of a percent, having topped $1.11 in the Asian trade. Focus will be on proposals expected from Athens for a deal to keep Greece and its banks financially afloat. A fall in U.S. yields following the release of minutes of the Federal Reserve's June meeting offered little hope to dollar bulls. The dollar index dipped as low as 96.123 in Asian trade.

Divergent monetary policies a more powerful EUR driver than Greek risks

Thursday, July 9, 2015 9:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns