Bitcoin’s price (BTCUSD) has been continuing further its two day’s rallies (i.e. shy above 9%), while the overbought sentiment paused BTCUSD rallies above $9k levels. Despite vigorous price slumps from the last couple of days, the bitcoin price managed to bounce back and reclaim $9k upon hammer pattern at $8,427.26 levels (i.e. testing support at around 21-DMAs).

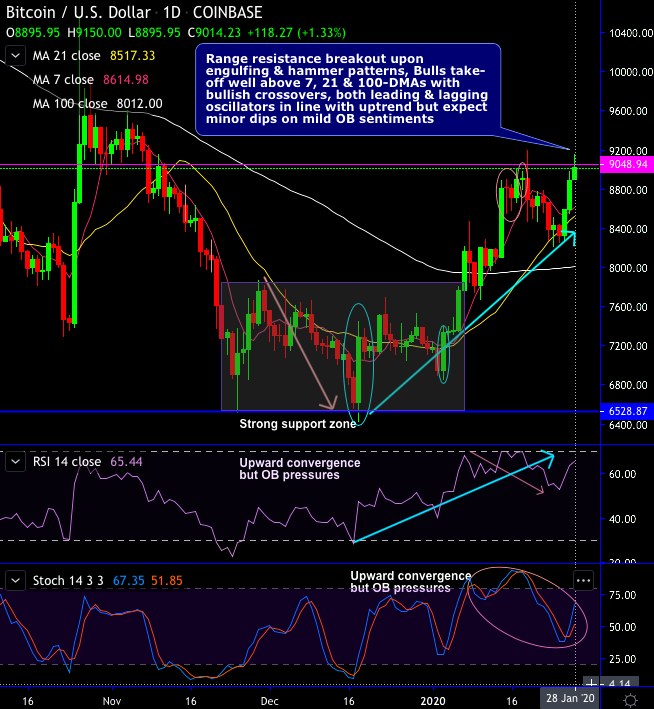

Technically, the range resistance has been broken out upon the bullish engulfing patterns, Consequently, bulls have taken-off well above 7, 21 & 100-DMAs with bullish crossovers (1st chart for daily plotting).

Shooting star followed by hanging man patterns plummet prices below EMAs, hammer and dragonfly doji counters with sharp rallies, the major trend jumps above 21-EMAs (refer 2nd chart for weekly plotting).

While both leading and lagging oscillators are in line with the prevailing uptrend but expect minor dips on the mild overbought sentiments.

Amid such a bullish travel, the pair has bounced from the lows of $6,430 to the recent peaks of $9,194.84 levels with rising volumes and open interest (OI) for CME bitcoin futures (refer 3rd chart).

As we could foresee further upside price risks, we have already advocated long hedges a fortnight ago so as to move in sync with the trend, now they must have not only arrested upside risks but also derived leveraged yields on trading grounds, we wish to uphold the same strategy on hedging grounds. Courtesy: JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data