Bitcoin price (BTCUSD at Coinbase exchange) has continued its bullish rout and reclaims $10k mark as predicted in our previous posts. It has shown 2nd consecutive weeks’ rallies from the lows $8,556.60 levels to the prevailing 10,056 levels. Such bullish streaks have taken-off the price of the pioneer cryptocurrency to hit the 4 and a half months highs as you can observe the monthly chart plotting.

Thereby, Bitcoin's market cap has risen to $180.55 billion as per coin market cap data, most importantly, the price has surged about a commendable 38% so far in 2020.

We reckon such a bullish sentiment is observed exclusively owing to traders and investors bidding for Bitcoin as a means of hedge against the lingering risks of key global elements and some other factors, we’ve listed some major driving forces:

1) Unsettled Geopolitical tensions: Like post-Brexit uncertainties in the UK, crude prices turbulence due to middle-east troubles.

2) Deadly contagious coronavirus outbreak: It has continued to disrupt trade and supply chains, impact financial markets, and force multinational companies to make production decisions with limited information.

3) Economic Slowdown: A steep and widespread productivity growth slowdown has been underway in DMs & EMs since the global financial crisis, despite the largest, fastest, and most broad-based accumulation of debt since the 1970s.

China accounts for one-third of global growth so a 1 percentage point slowdown in the country's growth rate is likely to have a material effect on global growth. The global impact will be felt through four real economy channels: sharply reduced tourism revenues, lower exports of consumer and capital goods, lower commodity prices, and industrial supply-chain disruptions. These spill-over effects could become larger if markets start to price in the risk of a material global slowdown and financial conditions tighten as risk premia rise across asset classes.

We would anticipate a growth rate of around 1.1% in the euro area for 2020, which is slightly lower than in 2019. Both within the euro area and globally, the biggest threat is a downturn in trade resulting from a range of uncertainties, primarily affecting manufacturing and hampering investment.

4) Low FX vols: The implied FX volatility is falling once again owing to the concerns surrounding the coronavirus. The historic lows seen last month have almost been reached again.

5) Bitcoin block reward halving: The trading sentiment of FOMO (Fear of Missing Out) as the price has surpassed major hurdles due to the upcoming fundamental event of ‘Bitcoin block reward halving’ has also been intensifying the prevailing buying sentiment.

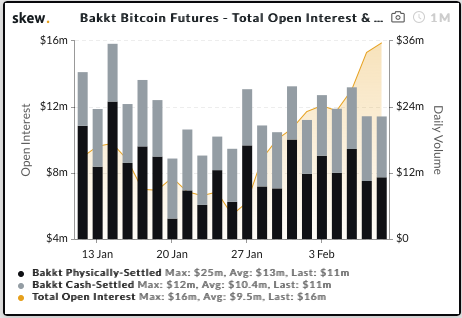

6) CME launched BTC Options: On 14th of this January, the pair (at Coinbase exchange) has shown a single day price jump of about 8.78%. The market veterans reckoned and gave the credit to the launch of CME BTC options likely contributed to the surge in an evolving cryptocurrency derivatives markets. As a result, the bitcoin derivatives trading flashes with its highest trading volumes on that day, while open interest in Bitcoin futures, for example, has soared to $3.5 million, as per the data compiled by Skew.

Hedging Outlook:

As we had foreseen the upside risks in the underlying security price upfront up to the retest of $13k mark again and advocated long hedges & trading strategies accordingly using CME BTC Futures, we continue to foresee further upside risks.

Hence, upholding the above strategy is wise thing to do by rolling over CME BTC Futures contracts of March deliveries on hedging grounds. Please be noted that on a fresh long build-up (rising price) coupled with the rising open interest and rising volumes is conducive factor from the contract holders’ perspectives (refer above chart).

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal