Bitcoin price rally has reclaimed $6,380.10 level which is on the verge of hitting a new 6-month high. The uptrend has been able to prolong surging higher above 6.25k mark today after breaking out a sentimental resistance of $6,000-$6,180 regions, which many traders and analysts reckon as a pivotal area for the cryptocurrency market to drive an imminent further bullish trend.

Well, technically, the bitcoin bulls have managed to break-out $5,759 levels which acted as strong support (now broke that stiff resistance, refer weekly chart for intermediate trend).

Thereby, BTCUSD has now been heading for the critical resistance between $6,856 level, considerably high volatility would be expected outside the channel.

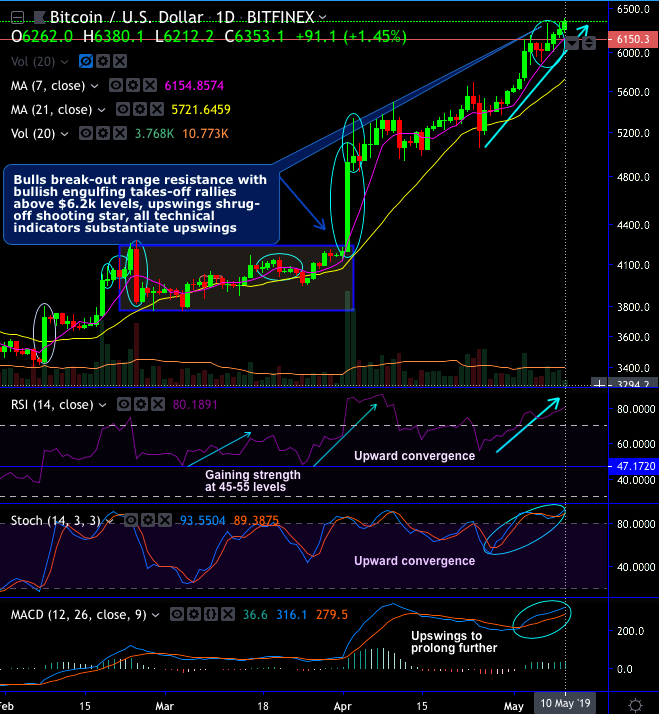

The pair break-out range resistance with a stern bullish engulfing candle in the minor trend, ever since then the prices are constantly spiking above DMAs (refer daily plotting).

The rallies are now shrugging-off bearish patterns, such as, shooting star and hanging man patterns as the current price goes above $6,154 levels (i.e. 7-DMAs), while all technical indicators still substantiate upswings.

Bullish engulfing patterns have occurred at $4,922.10 on daily, and at $4,071 and $5,238 levels on weekly plotting.

Well, these bullish engulfing patterns are coupled with bullish EMA & MACD crossovers signal upside price traction as the current price breaks-out stiff resistance & spikes well above 21-DMAs and EMAs.

Both momentum oscillators (RSI & Stochastic curves) show upward convergence to the current upswings that indicate the intensified buying momentum (on both timeframes).

Overall, after 2018’s bearish streaks, the pioneer cryptocurrency has begun to consolidate again. Foreseeing further rallies on cards and the resumption of the major uptrend, in the long run, it is wise to capture minor price dips to construct long build ups for the medium term targets up to $6,814 levels with a strict stop loss of $5,395 level (spot reference: $5,985).

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 124 levels (which is highly bullish), while hourly USD spot index was at 32 (mildly bullish) while articulating (at 06:10 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate