United Kingdom's vote to leave the European Union is likely to considerably increase political uncertainty in the near term, causing lower investment activity and thus lower growth in GDP and employment in the Nordic region. Outlook for Danish economy also deteriorates in the wake of Brexit.

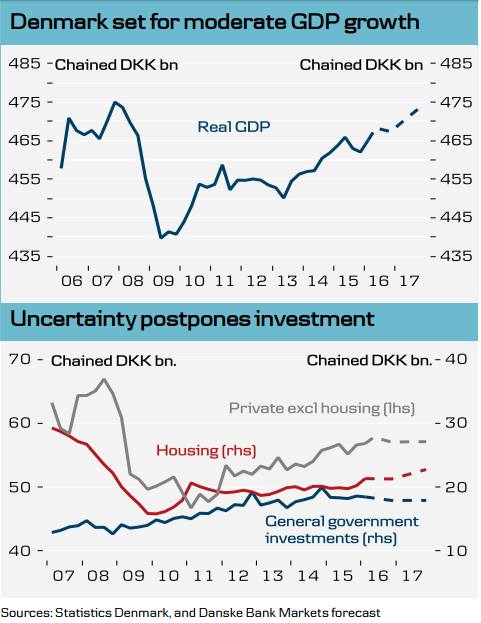

The Danish economy, in the first quarter, had surprised on the upside with GDP growth of 0.5 percent q/q after a disappointing H2 2015. Denmark’s tentative economic recovery could be derailed, wiping out hopes of a more than 1 percent growth in output next year, said Danske Bank in a report.

The UK is Denmark’s fifth largest trade partner and Danish exports to the UK are worth 70 billion kroner annually – around 7 percent of its total national exports. The risk of administrative burdens and a toll wall could negatively influence Danish exports to the UK in the long run. Denmark has the 2nd 'Most Competitive Economy' in the EU according to new IMD ranking and it is also likely to see haven currency inflows, pushing down interest rates and forcing the central bank into easing measures.

As European recovery to shift into a lower gear, given the general uncertainty, demand for Danish goods and services is set to weaken. The slowdown is likely to feed through to global trade, which is vital for Denmark’s large sea transportation exports. This would further dampen services exports. Job growth in Denmark is set to slow. Subdued investments and slow foreign demand growth would also weaken the outlook for job growth. The increased uncertainty and limited job growth could feed through to consumer spending.

"We have updated our economic forecasts in light of the Brexit vote. We expect GDP to be broadly flat for the remainder of 2016 and to start growing at a moderate pace next year," said Danske Bank.

EUR/DKK was trading at 7.4375, while USD/DKK was at 6.6888 at around 1040 GMT.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed