Dollar index trading at 94.98 (+0.03%)

Strength meter (today so far) - Aussie -0.95%, Kiwi -0.97%, Loonie -0.10%.

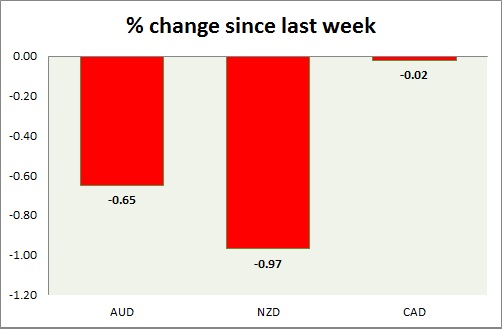

Strength meter (since last week) - Aussie -0.65%, Kiwi -0.97%, Loonie -0.02%.

AUD/USD -

Trading at 0.775

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/ Buy support

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- NIL

Commentary -

- Aussie is dropped sharply ahead of FED today. FOMC could turn out as make or break event for Aussie

NZD/USD -

Trading at 0.699

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.7-0.693(broken)

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.72

Economic release today -

- GDP to be released at 22:45 GMT.

Commentary -

- Kiwi failing to bounce back, dropped sharply ahead of FED. Kiwi remains sell against dollar. Selling at break out and rallies are recommended.

USD/CAD -

Trading at 1.23

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy Support

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28

Economic release today -

- NIL

Commentary -

- Canadian remains sell against dollar, however higher oil price is providing necessary support to loonie. Focus is on FED.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?