Dollar index trading at 95.18 (-0.25%)

Strength meter (today so far) – Aussie -0.00%, Kiwi +0.46%, Loonie -0.11%

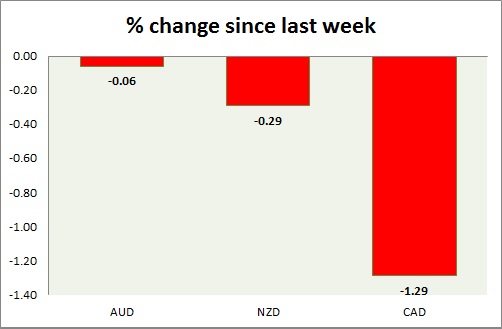

Strength meter (since last week) – Aussie -0.06%, Kiwi -0.29%, Loonie -1.29%

AUD/USD –

Trading at 0.718

Trend meter –

- Long term – Range/Sell, Medium term – Buy, Short term – Range/Buy

Support –

- Long term – 0.7, Medium term – 0.72, Short term – 0.72 (broken)

Resistance –

- Long term – 0.825, Medium term – 0.79, Short term – 0.76

Economic release today –

- GDP rose by 3.4 percent y/y in Q2.

Commentary –

- The Australian dollar is the best performer of the day but gave up earlier gains on strong USD.

NZD/USD -

Trading at 0.658

Trend meter -

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.62, Medium term – 0.65, Short term – 0.65

Resistance –

- Long term – 0.725, Medium term – 0.7, Short term – 0.675

Economic release today –

- ANZ commodity price index down 1.1 percent.

Commentary –

- The New Zealand dollar is up today on a weaker dollar. Active Call - Sell kiwi targeting 0.62 area.

USD/CAD –

Trading at 1.319

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.26, Medium term – 1.29, Short term – 1.3

Resistance –

- Long term – 1.35, Medium term – 1.33, Short term – 1.32 (testing)

Economic release today –

- BoC kept interest rate unchanged at 150 bps at today’s meeting.

- July trade balance came at -$0.11 billion.

- Labor productivity up 0.7 percent in Q2.

Commentary –

- Loonie is the worst performer of the day, as the U.S. moves ahead in forging an agreement with Mexico with Canada.