September month saw the lacklustre launch of new bitcoin futures on the Intercontinental Exchange with the physical delivery in the Bakkt Warehouse.

Bitwise Bitcoin ETF proposal has been rejected. The US-SEC announced on October 9th, that the commission stated that the ETF filing from Bitwise Asset Management and NYSE Arca is not complied by the necessary requirements.

While the daily traded volume of Binance futures currently stood at $499million USD, representing 39% plummeting from the ATH volumes.

The listing of futures with physical delivery by Bakkt on a regulated exchange should actually serve to enhance the bitcoin market structure by allowing investors, particularly miners, to better hedge existing bitcoin exposures. This is because existing cash-settled futures may only allow for imperfect hedging as hedgers are susceptible to price risk associated with converting bitcoin to cash at maturity. And there is an issue of potential manipulation with cash-settled contracts as settlement is based on a collection of spot prices from a number of exchanges with variable liquidity, which traders may be able to manipulate around the time of the futures contracts expiry.

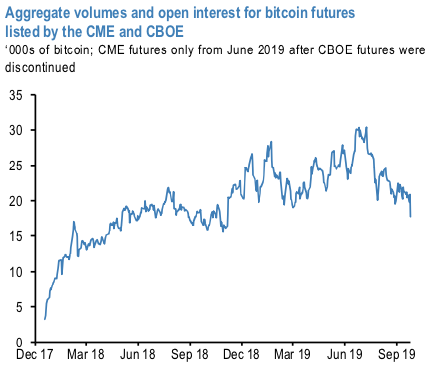

Following the launch of the new physically delivered contracts, initial volumes after trading started this week have been rather low with less than 100 bitcoin traded on the first day. We note, however, that these low initial volumes carry echoes of the initial listing of cash-settled bitcoin futures by the CME and CBOE in December 2017. Initial volumes were low (refer 1st chart), but the open interest kept growing steadily. The listing of the CME futures coincided with all-time highs in bitcoin prices, and researchers at the San Francisco Fed suggested that by providing a market where bearish positions could be more readily expressed the listing of these futures contributed to the reversal of bitcoin price dynamics. In a similar vein, it may be that the listing of physically settled futures contracts (that enables some holders of physical bitcoin e.g. miners to hedge exposures) that has contributed to recent price declines, rather than the low initial volumes.

In addition, we noted a few months ago (F&L, Jul 19) that the summer peaks in bitcoin prices coincided with overbought conditions in both CME and BitMEX futures contracts. Has an unwind of these positions contributed to the recent declines? To infer positioning in bitcoin futures we use our open interest position proxy methodology, previously applied to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors’ increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa.

When there is a price decrease, the net long position of spec investors decreases also with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest).

The position proxies for the CME and BitMEX futures contacts are shown in the 2nd chart. The CME position proxy suggests the long base has declined markedly since their peak during the summer, and some further reduction this week. By contrast, the BitMEX position proxy suggests a more marked capitulation of bitcoin longs over the past week. This position liquidation has also likely contributed to the sharp falls in bitcoin prices this week. But while the previous overhang of long bitcoin futures positions appears to have cleared in BitMEX futures, this is not yet true for CME contracts. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics