Upcoming Tuesday is the expected date of the 4-year block reward halving for the bitcoin network, when the number of new bitcoins that are created via the block reward is reduced by half.

The next halving will be the third such event, and the current block reward of 12.5 bitcoins will reduce to 6.25 bitcoins and hash-rate hits all-time highs.

Hash-rate has increased by 31% in the lead up to the 2020 halving, meaning miners have increased block production in anticipation of the supply-side event.

The Bitcoin hash rate spiked to 267 Billion Gigahashes per second on May 3rd, 2020, in the lead up to the block reward halving event. An average of 144 blocks are mined every day which means approximately 1,800 new bitcoins are generated every 24 hours.

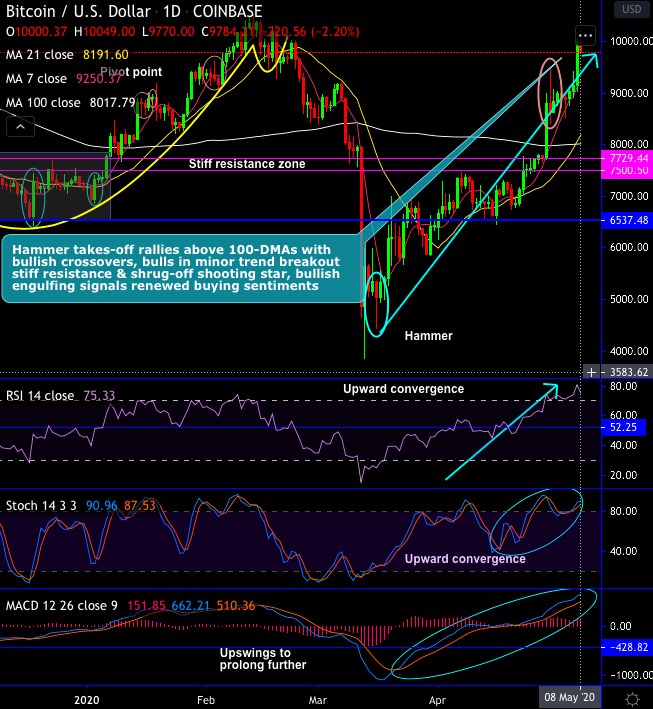

Ahead of this fundamental event, bitcoin price has resumed its bullish business (1st chart) as expected in our previous post, the renewed strength by edging higher above $9.2k levels. Although the pair BTCUSD, has surged considerably so far and staged for 8th consecutive weeks’ rallies (refer 2nd chart) amid pandemic coronavirus crisis, some sceptics of crypto-space still looks apprehensive ahead of block-halving event that is scheduled for 13th of May that drives them to maintain smart hedging at least.

Accordingly, the long hedges have already been advocated using CME BTC Futures about one and half month ago. In addition, 1m ITM call options have also been recommended.

These positions have been functioning as per our expectations so far, if we keep speculating on the next upside target and accumulate fresh bitcoins, it would be unwise. Instead, one can certainly uphold the above advocated long hedges for now.

Please be noted that since mid-March, BTC has spiked from $3,858 to the current highs of $10,000 which is 159% rallies & staged for 8th consecutive weeks' highs. And, from April'16, the BTC has spiked from $414 to the all-time highs of $19k, currently, trading decisively at $10k levels, which is still a mammoth 2,315% rallies.

Therefore, in addition to the long build-ups, for those who are already holding bitcoins are advocated the above-mentioned hedging strategies at this juncture.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts