There are a plethora of options in cryptocurrency derivatives marketplace as the digital assets as evolving gradually, the new start-ups like ICE’s Bakkt, BitMEX, LedgerX, Grayscale, OKEx, Deribit, and bitFlyer are lined up with their new derivatives products for crypto-assets to target their market share.

Amid a competition in the evolving industry, the Chicago Mercantile Exchange (CME) Group maintained their dominance by recording considerable volumes in 2019 for its bitcoin futures trading which are cash-settled, screening renewed interest in this avenue.

Well, we’ve already reported Bitcoin’s new volume persuaded the futures market, CME bitcoin futures trading observes massive growth of 63.5k contracts traded in the recent past.

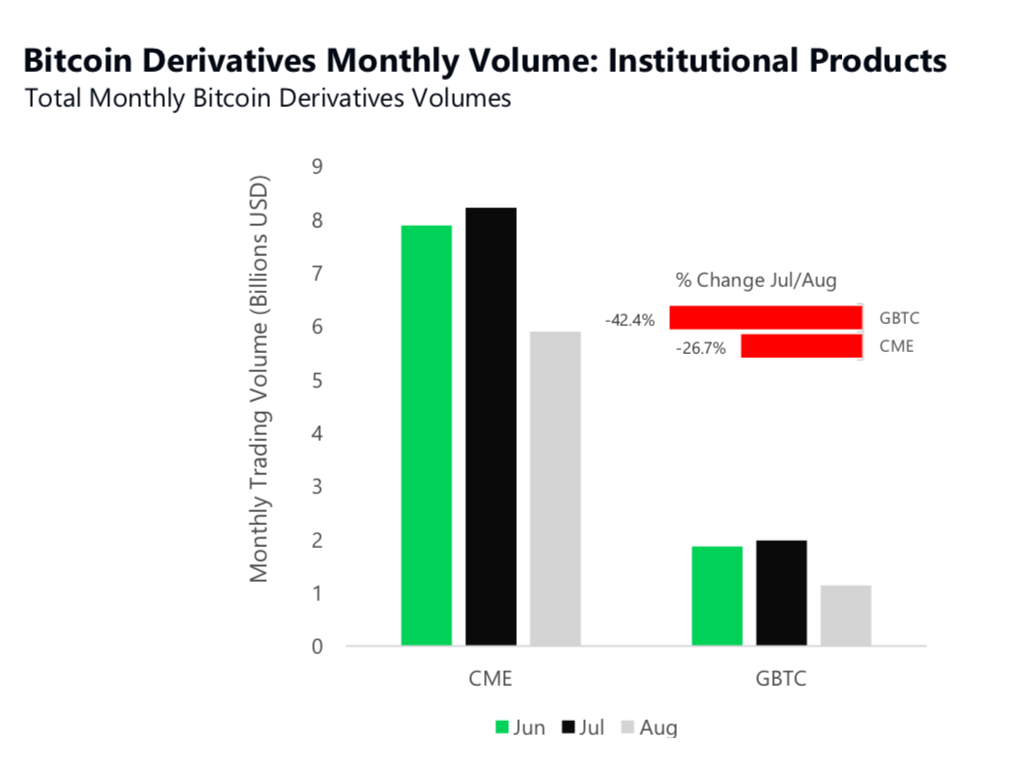

As per a report for the month of August by the cryptocurrency data providing company, ‘CryptoCompare’, Chicago Mercantile Exchange (CME) has been dominating in the gamut of derivatives, the regulated Bitcoin derivatives product for the CME in August was $5.9 billion. The exchange has been leading the space despite witnessing a 26.7% decrease since July.

As you could refer to their report, the regulated bitcoin derivatives product volumes are also highest by CME, whose total trading volumes are down 26.7% since July at 5.9 billion USD.

CME’s bitcoin futures product volumes decreased from a total of 8.06 billion USD traded in July to a total of 5.9 billion USD traded in August. Meanwhile, Grayscale’s bitcoin trust product (GBTC), decreased in terms of total trading volume with 1.14 billion USD traded in August (down 42.4% since July).

A probable cause of this drop was the close of a major round of CME Bitcoin futures contracts. Over 50% of CME Bitcoin futures open interest expired last week. It’s likely that most of this money flowed out of Bitcoin futures and into other derivative markets.

Daily volumes for BTC on the CME have been steadily falling over the last two months and institutional traders may be looking at other asset markets for new profit opportunities.

The prices of CME BTC futures contracts are cash-settled and would be subject to the CME CF Bitcoin Reference Rate (BRR) for the financial benchmarks.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary