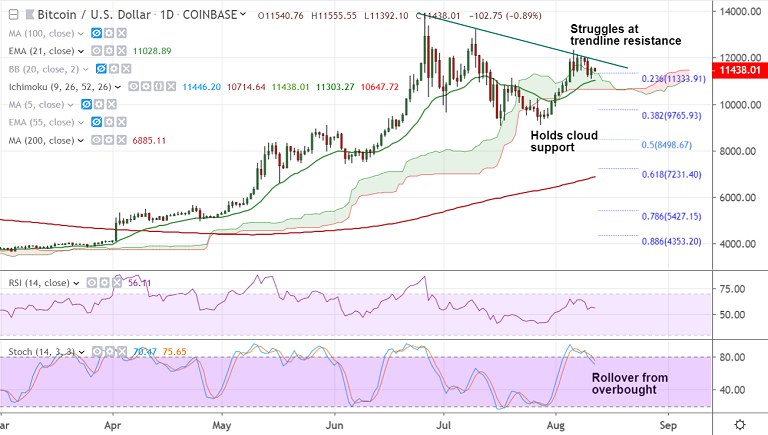

BTC/USD chart - Trading View

Exchange - Coinbase

Support: 11029 (21-EMA); Resistance: 11556 (200H SMA)

Technical Analysis: Bias Neutral

BTC/USD opens Monday's trade on a weaker note. Trades 0.75% lower at 11454 at 04:30 GMT.

Upside is capped at 5-DMA resistance at 11622. And cloud offers strong support on the lower side at 11303.

Major trend remains bullish as indicated by GMMA indicator. Both short and long term moving averages are biased higher.

However, technical indicators highlight scope for a minor downside. Stochs are on verge of rollover from overbought.

The pair is struggling to break above strong trendline resistance and 5-DMA is showing a slight turn.

Immediate support is 21-EMA at 11026. Break below will see dip till 55-EMA at 10423.

On the flipside, breakout at 200H SMA (11556) will see resumption of upside.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary