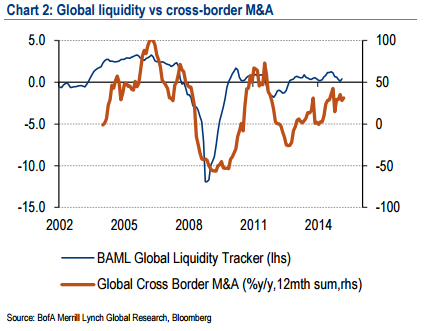

2014 was the strongest year for global cross-border M&A since the financial crisis with the deal count approaching 2011 levels .

This is only the second time since the turn of the millennium that global cross-border deal volume has surpassed the $1trn mark.

The significance for FX markets is the extent to which these deals have been transacted on a cash basis.

This is a reflection of the elevated cash levels held by corporate and the reluctance to use debt markets as a source of funding.

Bank of America Merrill Lynch says..

- On a trend basis, cross-border M&A has continued to improve into 2015.

Global monetary conditionsshould remain supportive for continued growth in M&A activity. - The BofAML global liquidity tracker remains broadly in positive territory as the significant ECB QE package announced in January should continue to underpin global liquidity conditions despite the prospect of the start of the Fed tightening cycle.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022