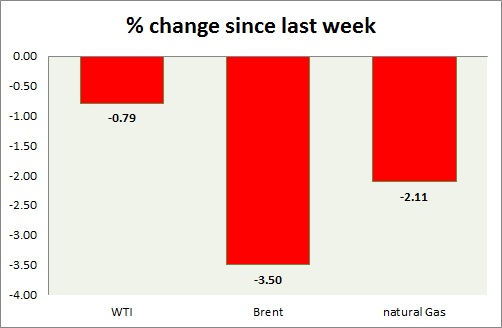

Energy pack is in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI bulls were halted at key resistance of $50 around yesterday, and fell further today. Today's range $48.6-47.3

- WTI jump back from $46 area was expected, however is likely to fall towards $42 area. The drop might extend below $40 area. $45 will serve as interim support.

- WTI is currently trading at $47.7/barrel. Immediate support lies at $42 and resistance at $54

Oil (Brent) -

- Brent is much better performer than WTI since yesterday.

- Brent-WTI spread rose by 40 cents since yesterday, currently trading at $5/barrel.

- Next target for Brent is around $51/barrel as support around $55/barrel got cleared. Jump back likely to remain curbed below $56/barrel.

- Brent is trading at $52.7/barrel. Immediate support lies at $50 area and resistance at $57 region.

Natural Gas -

- Natural gas bulls were halted at $2.95 area this week and fell sharply towards $2.7 support post FOMC. Today's range $2.8-2.74.

- Price might reach as low as $2.35 if it clears $2.7 mark, since bulls failed to break $2.95 area once more.

- Natural Gas is currently trading at $2.74/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.95, $3.04, $3.32.

|

WTI |

-0.79% |

|

Brent |

-3.50% |

|

Natural Gas |

-2.11% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary