Chinese stock market is the most volatile in the world. At the peak of the crash, 5 day average of realized volatility reached close to 10% for its benchmark stock index Shanghai Composite. It has fallen substantially over intervention but still around 4%, still high compared to global standard

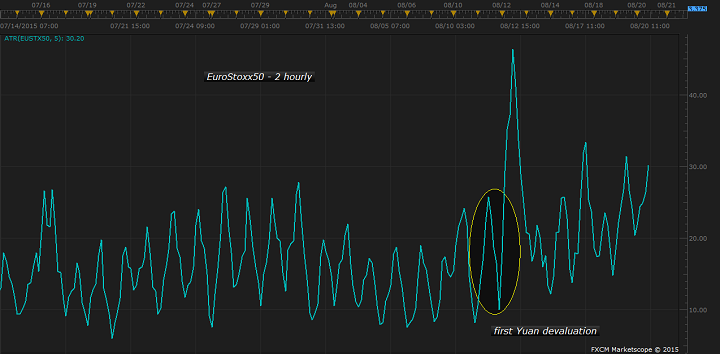

In a bid to better manage its currency, Chinese central bank devalued Yuan resulting in a spill-over of volatility across global market, especially in European equity markets.

- Emerging market currencies along with mining stocks are being hammered all across globe, as fear is rising for hard landing in China. China might be weaker than many had originally assumed and there is a growing risks that in spite of denial by People's bank of China (PBoC), there could be further devaluation even market driven one.

- Chinese devaluation of Yuan for three consecutive days last week, clouded monetary policy and its effect from European Central Bank (ECB) and raised the risk of currency war.

European blue chip index, EuroStxx50 registered substantial rise in volatility. 5 day average of realized volatility has almost doubled, both daily and intraday.

5 day average of daily realized volatility is up from around 1% before intervention to 1.8% as of today and 2 hourly volatility jumped from 0.5% to 0.9%, while the index lost about 8.5% since the intervention.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary