Chinese chipmaking stocks soared as reports of domestic advancements in extreme ultraviolet (EUV) lithography technology emerged, signaling potential independence from U.S. sanctions.

Semiconductor Manufacturing International Corp (HK:0981), China’s largest chipmaker, rose 7.4% in Hong Kong trading, while Sunny Optical Technology Group Co Ltd (HK:2382) gained 5.4%. Hua Hong Semiconductor Ltd (HK:1347) added 3.4%. Shanghai-listed Will Semiconductor Co Ltd (SS:603501) and Shenzhen-listed NAURA Technology Group Co Ltd (SZ:002371) saw gains of up to 2%.

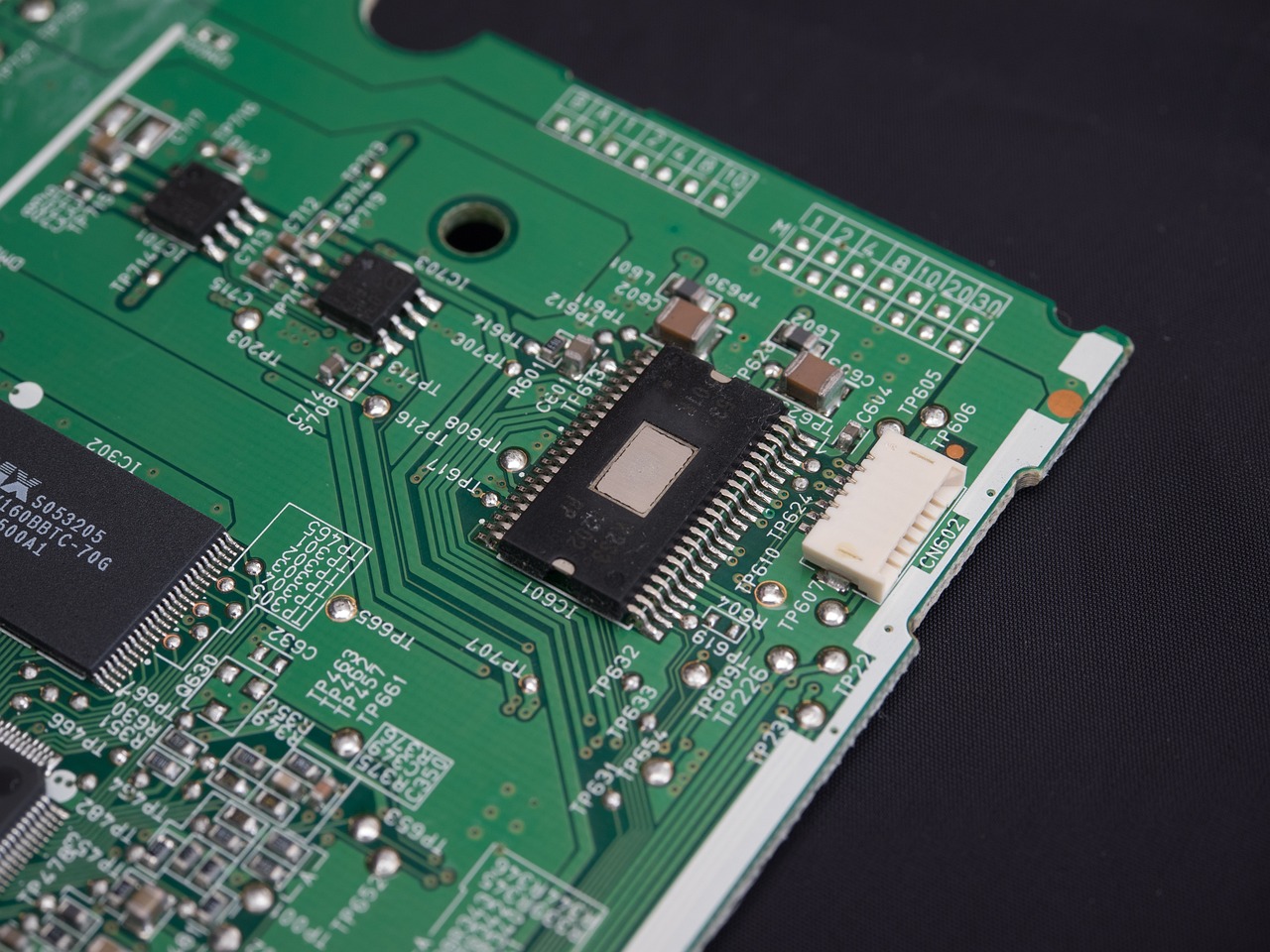

Local media revealed that scientists from the Harbin Institute of Technology developed a compact, stable EUV light source, enabling the production of advanced sub-7nm chips. This breakthrough could allow Chinese chipmakers to bypass reliance on Dutch EUV equipment manufacturer ASML Holding NV (AS:ASML), which is prohibited from selling such technology to China under U.S. sanctions.

The latest sanctions, aimed at slowing China’s progress in artificial intelligence (AI), have restricted local access to advanced chipmaking tools. However, China's progress in EUV technology boosts the potential for domestic chipmakers to produce cutting-edge AI chips without U.S. technology, mitigating the impact of these restrictions.

Additionally, Beijing’s push to incentivize local chip production is expected to further drive demand in the domestic semiconductor industry, providing a cushion against geopolitical pressures. These developments come amid heightened tensions as global leaders continue adopting hawkish stances against China’s technological advancements.

China’s advancements in EUV technology represent a significant step forward in its ambition to achieve self-reliance in semiconductor manufacturing and maintain a competitive edge in the AI sector.

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing