- Latest data suggest that the slowdown in China is real. Last year GDP has slowed to multi decade low to 7.4 percent. This year it is widely expected that government will reduce the GDP estimate further towards 7%.

- Even the GDP fell in China or falls further towards 7 percent, it is a commendable number compared to developed nation. Chinese economy grew to become the second largest in the world and after long double digit growth a period of cooling is natural and manageable.

- Peoples Bank of China (PBOC) has cut the benchmark interest rate twice to current 5.35 percent. It also in February reduced the reserve requirement by 50 basis points.

- Deeper look at situation suggests that these cuts were introduced not from growth concern but reduce the burden of corporate debt and keep ample liquidity in the system in events of failure.

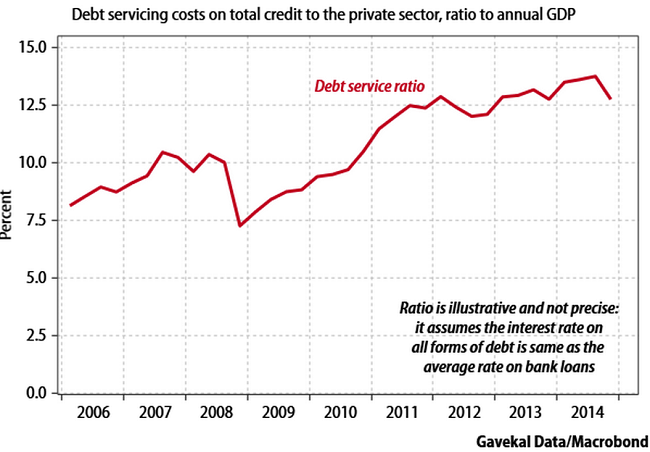

- Total debt in China could be as high as 240 percent of the GDP and non-government debt close to 200 percent of GDP. Even after the reduction debt service cost remains elevated above 10 percent.

- Chinese companies have been experiencing very high debt service costs well above 10 percent since 2010. Chinese companies have also gobbled up lots of dollar denominated debt which could become costlier to service in event of rates rise by Federal Reserve and fall in Yuan against dollar.

Swings in the Yuan rates and failure of the Chinese stock market to hold gains even after fall in interest rate suggest that market remain cautious over the situation. The Yuan could continue its fall against dollar in coming months. Yuan is currently trading at 6.274 down 0.3% for the day. CSI300 is trading at 3263 down 2.1% for the day.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings