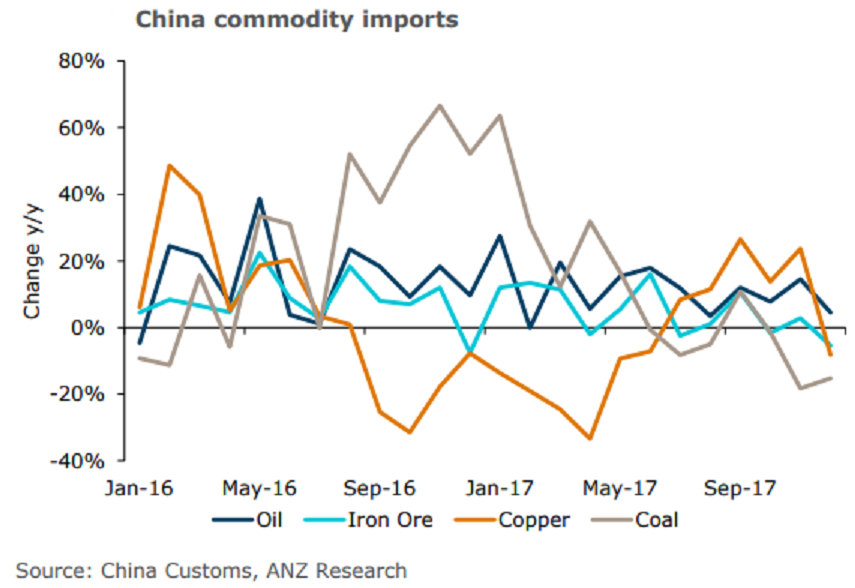

China’s levels of imports of major commodities remain elevated in December, as domestic demand remained robust amid ongoing supply constraints. Year-on-year growth rates eased slightly, raising some doubt as to continued strong growth in 2018.

Natural gas was the standout, with imports rising 30.2 percent y/y to 7.9 million tonnes. A recent easing in restrictions on coal use in heating had raised fears of weaker gas demand. However, it’s clear that the industrial sector continues to drive overall demand amid China’s ongoing focus on reducing pollution.

Crude oil imports were also strong, up 4.6 percent y/y to 38 million tonnes (8.99mb/d) in December, which resulted in total 2017 imports growing 11.4 percent. Iron ore imports eased slightly from November (-11 percent m/m) as winter cuts at steel mills eventually impacted demand.

However, the y/y fall was much smaller (-5.4 percent) suggesting demand of higher-grade ore from exporters such as Australia and Brazil is still strong. Copper imports were also weaker, falling 8.2 percent y/y to 450,000 tonnes in December. But much of this was due to base effect, with December 2016 imports particularly strong. Meanwhile, last month’s volumes still represent the third highest over the past two years, suggesting demand remains robust.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices